Background

Eagle Alpha has been fielding inquiries from clients for many years on alternative datasets that either originate in China or can address investment use cases in China. In general, the queries are broad macro use cases to track the Chinese economy or datasets that can be used to monitor consumer spending trends. Within consumer spending, the majority of investors have looked for information on western brands that have a large exposure to the region or have China as a significant part of their quarterly revenue growth. We have pulled together content across Data Strategy related to these themes but also address other datasets that investors are interested in. Any discussion on alt data involves complex legal issues and when it comes to China the issues can be particularly tricky. We will highlight relevant content on the subject.

Data Sources

In a recently published case study deck of alt data use cases relevant to China, we highlighted that interest from investors comes from two main areas, macro use cases and datasets applicable to consumer companies. There are other areas of interest, which we gave examples of in the case study deck, but macro and consumer are the most prevalent inquiries we get.

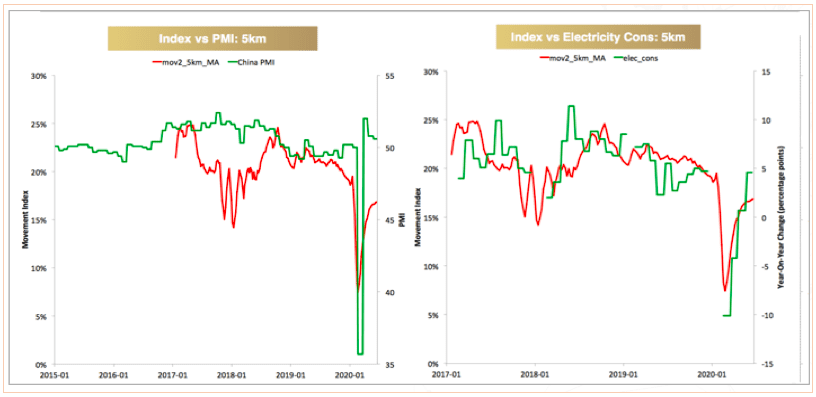

Figure 1: People Movement Index – China Economic metrics

Figure 1: People Movement Index – China Economic metrics

Sources of macroeconomic indicators vary from satellite to trade data and job listings data. One interesting source of data highlighted in our recent case study is geo-location data or people movement data. As can be seen in figure 1 above, an index of the people movement is correlated to Chinese monthly PMI statistics and also electricity consumption. Both are important measures of economic activity. People movement data is high frequency and offers faster insight into evolving economic developments. It also means that the data is available well in advance of reported metrics by government agencies.

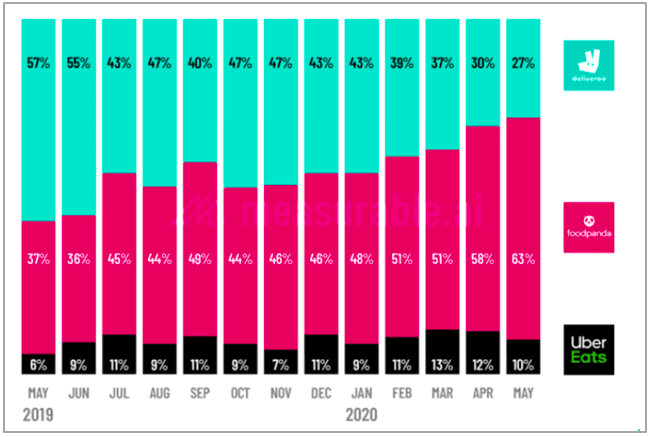

Figure 2: Market Share Food Panda -Hong Kong

Figure 2: Market Share Food Panda -Hong Kong

A recent Alpha Centre case study showed how email receipt data can be used to track consumer behaviour and market share trends for food delivery companies in Asia, including Hong Kong. The case study showed how Delivery Hero subsidiary Food Panda was gaining share in Hong Kong (Fig 2) and Asia.

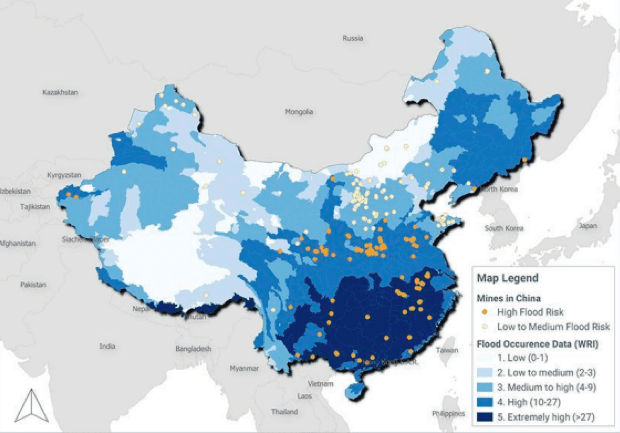

Figure 3: Mining Company Operations

Figure 3: Mining Company Operations

A case study from 2019 using S&P Global Market data on mining companies in China and Brazil highlighted that China is lagging when it comes to ESG risks. Mining companies were found to have poor governance and environmental risk management controls. In addition, using satellite data these companies were seen to be operating in flood plains (Fig 3).

[Data Strategy clients can click here to access all the alt data use case decks and case studies from Alpha Centre.]

Expert Discussions of Alternative Data in China

We have held many Alpha Workshops on topics such as web crawled data and consumer transaction data that would be equally applicable to China investment use cases. But we also have recordings and summaries of China-specific workshops on the Data Strategy platform. For example, early in the onset of COVID-19, when investors were focused on China, we held a workshop on the Coronavirus outbreak. We had ten alternative data vendors discuss the outbreak and how their data could be applied to what was then a developing situation. In May as part of our virtual COVID-19 conference, we also hosted a panel on the economic impact of COVID-19 in China. An Alpha Workshop on trade data is also highly relevant to China given the importance of the Chinese economy and world trade flows.

Two of our Expert Hub contributors have made comments relevant to Chinese related datasets. Dr Alan Kwan has discussed big data in China among other alternative data topics. Dr Kwan has highlighted that consumer data can be more extensive in China than in the west. This may be due to different privacy laws, but it can also be a result of the sheer scale of the Chinese market. Satellite data is widely used by investors for macro and equity use cases and Saeed Amen has given a high-level overview of computer vision and object detection for satellite data that users of the data should be aware of.

[Data Strategy clients can click here to access content from all our Alpha Workshops]

Legal Considerations

Chinese datasets share many of the same legal considerations as any other alternative data source as regards MNPI and PII. However, in December 2019 we hosted a legal workshop focused exclusively on Chinese datasets. It was pointed out on the workshop that the legal environment in China surrounding alternative data is complex and fast-moving. Over the past two years over twenty new cybersecurity laws have come into effect.

Speakers on the workshop also highlighted political implications in China, particularly when it comes to cross border data transfer. This data transfer issue came up again in 2020 when the government imposed further restrictions on technology and data exports. Another important aspect of Chinese laws that may not arise in the west is laws around monopoly and competition law. The current precedents in China tend to protect original data developers, but there is no consensus if the capture or reuse of data necessarily constitutes unfair competition.

Legal complications may also arise with data vendors that have been collecting data for years, but regulation is just catching up. This can mean that established vendors may not be compliant. The complexity and political implications for Chinese datasets make it imperative that investors perform rigorous due diligence on data provenance before making use of the data.

[Data Strategy clients can click here to access the archive of legal workshops and click here to access our archive of legal articles.]

Conclusion

With ever-changing legal and political dynamics in China, investors need to be particularly diligent in sourcing and deploying Chinese data in their investment strategies. Having said that, investors are eager to utilize alternative data in their China investment strategies. Macro and consumer-related datasets are in particular demand. Macro datasets are in demand as a tool to augment official government statistics. Equity use cases for western brands are most sought after and in the past availability and applicability of such data was difficult to come by. However, in recent years more data has become available for investors to track the consumer and luxury goods sectors.

To learn more please contact datastrategy@eaglealpha.com