Towards Cleaner Energy Investing: How Alternative Data Can Help Evaluate the Transition

Background

Investing in energy markets can encompass a wide range of opportunities, including traditional fossil fuels, renewable energy, energy infrastructure, and related technologies. Historically, investments in oil and gas exploration and production have generated substantial returns during periods of high oil prices, especially during the price spikes of the 1970s and early 2000s. However, macro effects during those periods were not similar.

Hedge funds have reportedly profited significantly from price changes triggered by Russia’s invasion of Ukraine, with the top 10 hedge funds estimated to have made nearly $2 billion in profits. When looking at longer-term project financing, a recent study has challenged the perception of fossil fuels having a significantly higher energy return on investment (EROI) compared to renewable energy sources.

While traditional EROI calculations for fossil fuels, such as oil and coal, have often exceeded 25:1 at the extraction stage, the new research indicates that when accounting for the energy required to transform fossil fuels into finished products like petrol and electricity, the EROI drops to roughly 6:1, and possibly as low as 3:1 in the case of electricity. The study suggests that increasing energy costs associated with fossil fuel extraction will lead to a further decline in EROI, potentially pushing energy resources toward a “net energy cliff.”

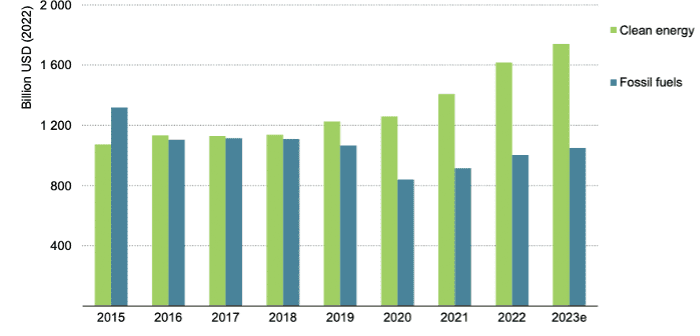

Global energy investments have gone through a period of transformative change in recent years. According to the International Energy Agency (IEA), this shift can be attributed to the recovery from the COVID-19 pandemic and the cumulative response to the global energy crisis. These changing dynamics have led to economic incentives for increasing energy supply, enhancing efficiency, and addressing energy security concerns. Figure 1 below shows that investments in clean energy are projected to reach 1.74 trillion USD by the end of 2023 while investments in fossil fuels have been stagnant.

Figure 1: Global Energy Investment in Clean Energy and in Fossil Fuels (Source: IEA)

According to the IEA’s Stated Policies Scenario, the demand for coal peaks in the next several years, the demand for natural gas plateaus by the end of the decade, and the demand for oil peaks in the middle of 2030s before starting to fall: “The result is that total demand for fossil fuels declines steadily from the mid‐2020s by around 2 exajoules (EJ) (equivalent to 1 million barrels of oil equivalent per day [mboe/d]) every year on average to 2050.”

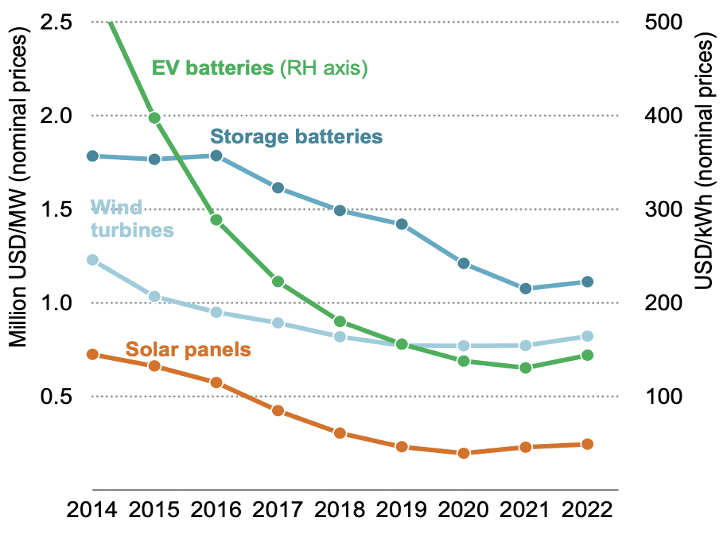

Several factors have contributed to the boost in clean energy investments. The rate at which renewable energy prices have fallen over the last decade has been a game changer, making it comparable in cost to building new coal and nuclear capacity. Improved economics coincided with high and volatile fossil fuel prices and with improved policy support like the US Inflation Reduction Act.

Changing consumer preferences played a role in the shift towards EVs. As more automakers introduce a wider variety of EV models, including SUVs and luxury vehicles, consumer choice has increased, appealing to a broader range of preferences and budgets. The growth of charging infrastructure is also removing one of the primary barriers to EV adoption – range anxiety. Figure 2 below shows that average prices for clean energy technologies have fallen significantly in recent years.

Figure 2: Average Prices for Selected Technologies (Source: IEA)

Climate Policies and Regulations

The Paris Agreement, a legally binding international treaty on climate change, was adopted by 196 parties in 2015 and came into effect in 2016. The primary objective of the Paris Agreement is to limit global warming to well below 2 degrees Celsius above pre-industrial levels, with an aspirational goal of limiting it to 1.5 degrees Celsius. This is crucial to avoid the most catastrophic effects of climate change.

It has had a significant impact on national policies and actions related to climate change in countries around the world. However, climate policies and regulations vary significantly across the world due to differences in government priorities, economic conditions, and environmental challenges. For example, republicans in the US passed a sprawling energy bill in March 2023 contesting that President Biden is too reckless in his desire for a quick transition away from fossil fuels.

The US Inflation Reduction Act of 2022 (IRA) is a comprehensive climate law with various energy-related tax incentives designed to combat climate change. According to the Roosevelt Institute, this legislation will shape the US markets and influence future generations. In August 2023, the Department of Energy reported 157 applications for clean energy projects totaling over 140 billion USD in loans.

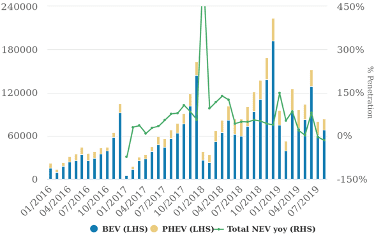

UN Secretary-General António Guterres urged countries, responsible for around 80% of global emissions, to accelerate emission-cutting efforts. However, major G20 nations like China, India, and Indonesia argue that aggressive emissions reductions could harm economic development. Cuts in new energy vehicle (NEV) subsidies in China resulted in a significant drop in sales which shows that it is essential to subsidize new technologies until they become cost competitive (see Figure 3).

Figure 3: Cuts in NEV Subsidies Led to Sales Decline in China (Source: Morgan Stanley)

There is a lack of consensus, however, on how quickly the transition to renewable energy should occur. According to the IMF, accelerating carbon emission reduction targets may lead to unforeseen macroeconomic disruptions. The scale and speed of the transition, which aims to transform a $100 trillion global economy within a quarter-century, pose unprecedented challenges. The uncertain pace of technological advancements and the divide between advanced and developing countries on priorities also pose significant challenges.

Alternative Data Availability

Several alternative data categories can be useful when analyzing energy markets.

Satellite data, also referred to as geospatial data, is photographic images collected by satellites orbiting the Earth and can be enhanced with data from drones and radar. Satellite imagery can track the construction and expansion of energy infrastructure such as power plants, wind farms, and solar installations. This helps in estimating the future energy supply. Satellite data is also increasingly used in oil and mineral exploration, land mapping, maritime operations, and in infrastructure management. ESG compliance and anti-greenwashing efforts create further demand for satellite imagery as it can be used to set benchmarks and measure the impacts of companies.

Understanding global commodity flows involves examining economic trade data which involves information on a specific commodity’s size, volume, mode of transportation, and market value. As such it is an important economic indicator of businesses, trade, and economic growth. The data is compiled using a variety of different sources. Some of these sources include online resources, government, public data, shipping firms, logistics companies, and transportation organizations.

Disruptions or bottlenecks within the supply chain can impact a company’s ability to deliver products on time, potentially affecting revenue and customer satisfaction. Energy companies are under increasing pressure to reduce their carbon footprint. Supply chain data and ESG data can be used to assess the environmental impact of various suppliers, transportation methods, and materials, helping companies make more sustainable choices.

Weather and climate data can be utilized to understand the impact of weather on investable assets, manage and mitigate weather & climate risk, generate trading signals, portfolio alignment with climate trajectories, and scenario planning. Weather data is essential for forecasting renewable energy generation, such as solar and wind power. Energy companies use historical weather patterns and real-time meteorological data to predict energy production, helping them balance supply and demand more effectively.

Furthermore, energy companies must adhere to a complex web of federal, state, and local regulations. Legal and regulatory data is used to monitor compliance with environmental, safety, and operational requirements. Non-compliance can result in fines and legal action.

For more information on the data sources mentioned in this article and recommended third-party data providers available to view on our buyer platform, please reach out to dallan.ryan@eaglealpha.com.

Conclusion

Investing in the energy sector is undergoing a profound transformation. While traditional fossil fuels have historically dominated, the rise of renewable energy sources and the urgency to combat climate change are reshaping the landscape. However, this transition is not without challenges. Regulatory uncertainties, geopolitical events, and varying opinions on the pace of change create a complex investment environment. As the world continues to grapple with energy-related issues and strives for a greener future, investors must adapt to these changing dynamics with alternative datasets helping to navigate the evolving landscape.