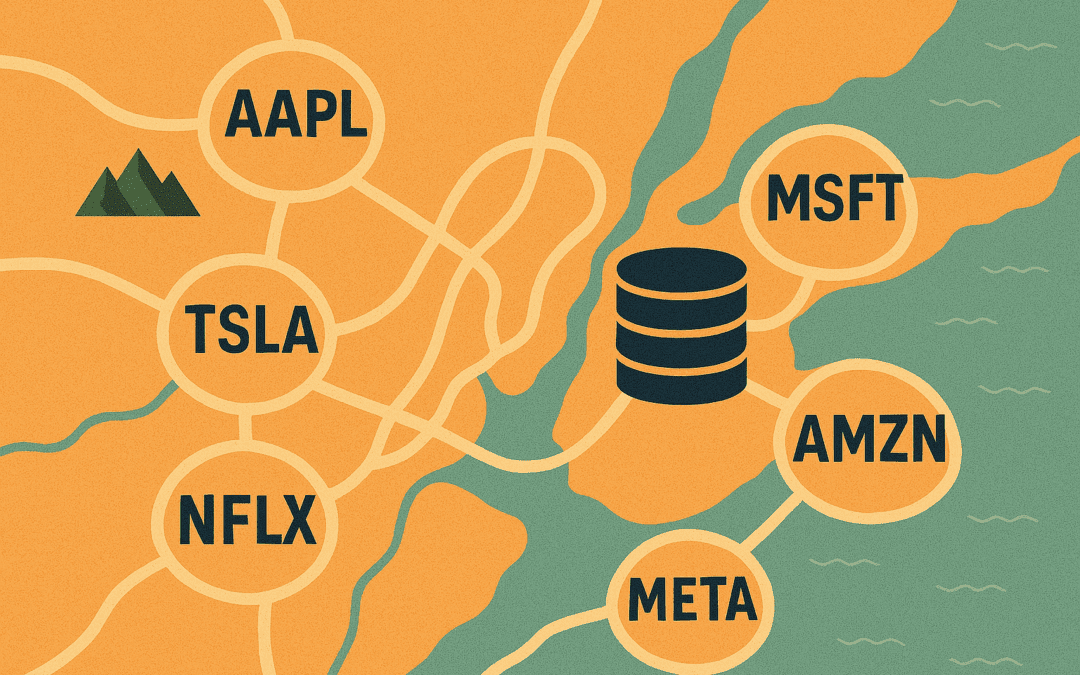

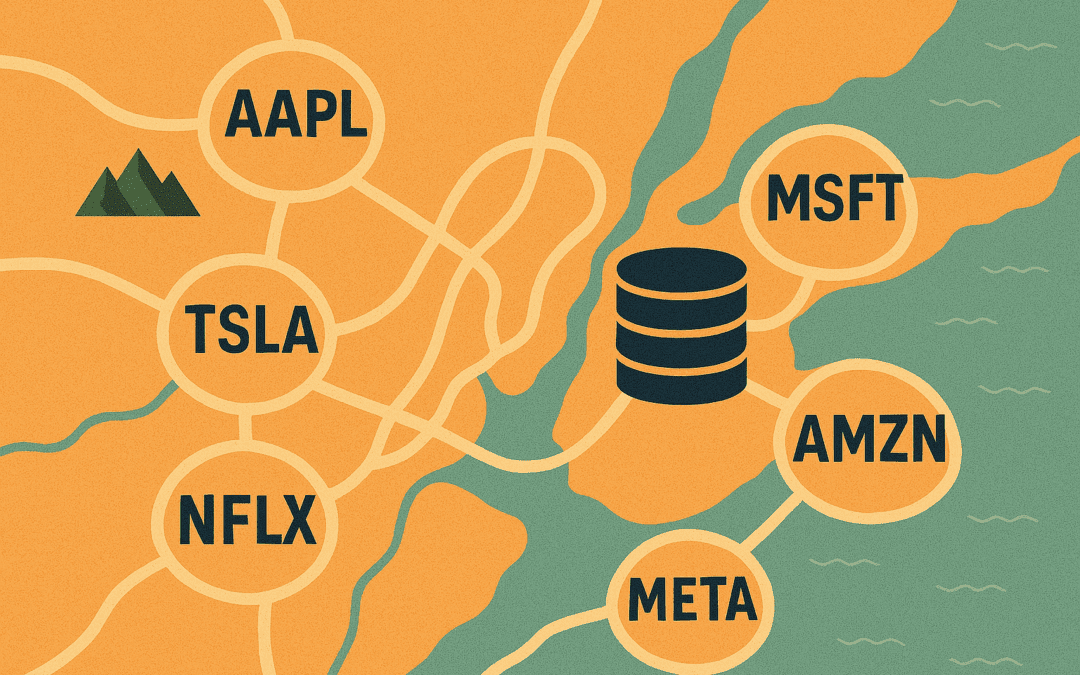

Learn effective strategies for mapping data to correct identifiers, symbols, & tickers, ensuring data accuracy & integration across platforms.

Learn effective strategies for mapping data to correct identifiers, symbols, & tickers, ensuring data accuracy & integration across platforms.

How a Mid-Size European SaaS Platform Turned a Simple Inquiry Into a Multi-Million Dollar Data Revenue Stream in 6 Months.

Eagle Alpha’s Alternative Data Conference in New York on February 12, 2025, brought together industry leaders, investors, and data providers for a day of in-depth discussions on the evolving alternative data landscape. The conference covered key themes, including the increasing regulatory scrutiny on AI and alternative data usage, insights into hedge fund technology, and the role of data in private equity. A summary of key private equity panels is presented below.

Eagle Alpha’s Alternative Data Conference in New York on February 12, 2025, brought together industry leaders, investors, and data providers for a day of in-depth discussions on the evolving alternative data landscape. The conference covered key themes, including the increasing regulatory scrutiny on AI and alternative data usage, insights into hedge fund technology, and the role of data in private equity.

Selling your data to asset managers can be a profitable venture. Understanding how to market your data effectively and set appropriate pricing is crucial to sell data. This guide provides practical advice on these aspects.

The Unbound Alternative Data Conference was held on October 9th at Convene’s Madison Avenue offices. The agenda included talks from experts in the fields of AI and data strategy, new-to-market vendors showcasing innovative datasets and fresh features, Q3 trends from category leading vendors, B2B technology, and compliance updates.

We explored insightful topics like building and retaining data teams, the convergence of market and alternative data, GenAI’s impact on data productization, M&A in the data world, and a deep dive into US consumer behavior using transaction data

As firms venture into alternative data, a common question emerges: "Where should we start?" This blog is tailored to firms taking their initial steps into alternative data strategy, drawing from Eagle Alpha's extensive experience and insights from working closely with...

Every day, Eagle Alpha helps guide data-intensive organizations towards the right datasets to answer their research question or fulfill their model requirements. One of the challenges with finding relevant datasets is assessing use case suitability among the wide...

Discover how alternative data monitoring consumer behavior and employee sentiment can provide investors with timely insights.