What Is Alternative Data?

Alternative data offers a fresh approach to forecasting company performance, diverging from traditional metrics like filings and forecasts.

Explore the transformative world of Alternative Data and its pivotal role in modern analytics. This comprehensive guide delves into how unconventional data sources—from employment trends to satellite imagery—offer deeper insights into market dynamics and consumer behaviors, enhancing predictive models and decision-making processes. Discover the vast potential of alternative data to drive innovation and strategic advantage across industries.

Alternative Data Explained

In today’s data-driven world, decision-makers seek every advantage to stay ahead. Alternative data offers a fresh perspective, tapping into non-traditional sources to unveil hidden insights and drive informed decisions. From social media insights to satellite imagery, web scraping to credit card transactions, alternative data paints a vivid picture of market dynamics and consumer behavior.

Far beyond traditional metrics, alternative data enriches analysis with unique perspectives and untapped business metrics and KPI’s. It’s not just about numbers; it’s about understanding the pulse of industries and markets in real-time and alternative data provides the tools to do this.

Embraced by businesses, investors, and researchers alike, alternative data opens new avenues for exploration. It’s the key to unlocking deeper insights into markets, uncovering emerging trends, and predicting consumer behavior with unprecedented accuracy.

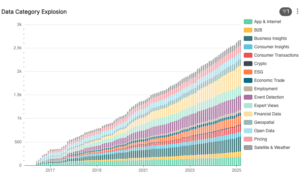

There are many different categories of Alternative Data and thousands of Alternative data providers. At Eagle Alpha, we categorize alternative data sources across 16 different primary categories and 56 sub categories that we have outlined below (Click on the alternative data category links to get deeper insights into our primary and subcategory taxonomy with over 1900 alternative data providers’ datasets’ catagorized).

We were the first firm to release an alternative data taxonomy and have since updated this taxonomy to reflect this quickly evolving space. Since 2016, we have seen an explosion in the number of alternative datasets available on the market. This number contiues to increase across all alternative data categories.

Alternative data has many use cases, whether it’s refining investment strategies, assessing credit risks, optimizing supply chains, or predicting consumer behavior, alternative data offers unparalleled opportunities.

Discover the power of alternative data with our marketplace of the best alternative data sources. Explore the alternative data marketplace through our API, uncover unique datasets, and harness the potential of alternative financial data to stay ahead of the curve.

Eagle Alpha’s Alternative Data Taxonomy

App & Internet Data

App and Internet data covers a broad range of alternative data that is collected via apps installed on users’ devices and through users’ online behaviors and preferences. App data is generated, collected, and stored by mobile applications on smartphones and other mobile devices. This type of alternative data can include a wide range of information, depending on the specific features and functions of the app.

The sub-categories of App & Internet alternative data include:

- App Usage Data

- IoT Data

- Online Search Data

- Social Media Data

- Web Traffic Data

B2B Data

B2B alternative data is data that is gathered by alternative data aggregators about companies and how companies interact and transact with each other. Aggregators gather alternative data from various sources and combine that data in a manner that is useful for companies to use themselves for competitive analysis, devising marketing and go-to-market campaigns, and generating prospects and sales leads.

The sub-categories of B2B data include:

- Firmographic Data

- Supply Chain Data

- Technographic Data

Business Insights Data

This alternative data category represents a heterogeneous group of datasets that provide unique insights into companies. These insights can come from a variety of alternative data sources, including customer data, market data, and operational data.

The sub-categories of Business Insights Include:

- Advertising Data

- Airlines Data

- Automotive Data

- Business Trends Data

- Energy Data

- Healthcare Data

- Patent Data

- Real Estate Data

- Telco Data

Consumer Insights Data

Customer insights are a collection of consumer behavior trends, statistics, and feedback that assist organizations in fully comprehending consumers and the choices they make while making purchases. To generate definitive consumer insights, gathering quantitative and qualitative alternative data from sources such as website metrics, social media mentions, market research, and customer analytics is critical.

The sub-categories of Consumer Insights data include:

- Consumer Credit Data

- Reviews & Ratings Data

- Surveys Data

Consumer Transaction Data

Consumer transaction data is one of the most popular and widely deployed types of alternative data by investment managers. The data is also used extensively by Private Equity and corporates with exposure to the retail segment of the economy. Quants and discretionary managers typically deploy the data to predict quarterly revenue growth and earnings. As the data is available before quarterly earnings are released, it is ideal to gauge if a company is going to beat or miss Wall Street estimates.

The sub-categories of Consumer Transaction data include:

- Credit & Debit Card Data

- Email Receipt Data

- Point of Sale Data

Crypto Data

Cryptocurrency, or “crypto” as it’s become widely referred to, has been one of the quickest-moving trends in the investment space in recent years, with retail and institutional investors throwing their hats in the ring. From on-chain analysis comprising a record of every step linked to the transaction and the modification of the blockchain following it to off-chain study consisting of steps outside of the blockchain, the breadth of information available to investors is quite wide and deep.

The sub-categories of Crypto data include:

- Event Risk Data

- Market Data

- Sentiment Data

ESG Data

‘ESG’ is a term that has become increasingly popular with investors and asset managers over recent years. Interest in ESG has grown significantly as the number of ESG-focused mandates has rapidly grown in the asset management industry. Furthermore, studies have indicated that COVID-19 has increased investor sensitivity to ESG issues, accelerating the ESG investing trend. With the introduction of new sustainable finance disclosure regulations and taxonomies from the UN and across the EU, North America, and Asia, it is more important now than ever to understand ESG data from the alternative data market.

The sub-categories of ESG data include:

- News NLP Data

- Raw ESG Data

- ESG Scores Data

Economic Trade Data

Economic trade data is knowledge of a specific commodity’s size, volume, mode of transportation, and market value. Alternative data for economic trade monitors how all commodities and products are moved globally between countries and within regions. As such, it is an important economic indicator of businesses, trade, and economic growth. This category of alternative data is compiled using a variety of different alternative data sources. Some of these alternative data sources include online resources, government, public data, shipping firms, logistics companies, and transportation organizations.

The sub-categories of Economic Trade data include:

- Air Freight Data

- Rail & Road Data

- Shipping Data

Employment Data

Technological innovation has allowed data aggregators to collect alternative data from disparate alternative data sources and aggregate that alternative data in a format that is helpful for asset managers, hedge funds, and private equities alike. One such category of alternative data is Employment Data which is commonly web scraped and collected from publicly available sources such as job boards, professional networking sites, employee review platforms, IRS filings, company disclosures, and news and trade publications.

The sub-categories of Employment data include:

- Human Capital Data

- Job Postings Data

Event Detection Data

Both fundamental and systematic asset managers employ event-driven strategies trying to predict the outcome of calendar events or the occurrence of significant events. Typical event-driven strategies include merger arbitrage, activism strategies, distressed investing, and special situations.

The sub-categories of Event Detection data include:

- Event Risk Data

- News NLP Transcripts Data

- NLP Transcripts Data

Expert Views Data

Asset managers use this expert views to gain additional alternative data insights into particular industries, companies, or markets that may not be readily available through other data sources. Experts can be individuals with specialized knowledge, such as industry analysts, consultants, academics, or former executives, who can offer unique perspectives.

The sub-categories of Expert Views data include:

- Credit Assessment Data

- Macro Economy Data

- Expert Surveys Data

- Reviews & Ratings Data

Financial Data

Financial Data contains datasets and categories that fall between traditional data and alternative data. Some years ago Eagle Alpha clients began asking for data that fell into the traditional realm. The thought process was that alternative data would just become data at some stage.

The sub-categories of Financial data include:

- Flows & Allocations Data

- Fundamental Data

- Tick & Price Data

- Trading Signals Data

Geospatial Data

This type of alternative data refers to any type of alternative data that can determine with precision the location of any object (Building, car, ship, etc.) or person in the world. This data is obtained from electronic devices such as mobile phones, tablets, smartwatches, and connected vehicles. Geospatial data derived from mobile devices can yield timely information on visitation trends.

The sub-categories of Geospatial data include:

- Geolocation Data

- Point of Interest Data

Open Data

Open data is alternative data that can be freely accessed, used, modified, and shared by anyone. The open data movement can be traced back to the concept of open access to scientific data and the formation of the World Data Center system in 1955.

The sub-categories of Open data include:

- Open Source Data

- Public Sector Data

Pricing Data

Pricing datasets contain information on the prices of various products or services. These alternative datasets typically include information such as the vendor, product name, unit price, currency, and date.

The sub-categories of Pricing data include:

- Automotive Data

- CPG Data

- e-Commerce Data

- Hospitality & Leisure Data

- Real Estate Data

Satellite & Weather Data

Satellite data, also referred to geospatial data, is photographic images collected by satellites orbiting the earth and can be enhanced with data from drones and radar. It is a common category of alternative data used by asset managers as the interpretation of satellite images into data and insights is useful on many fronts e.g., general economic activity, agriculture, mining, construction and real estate, shipping, oil and gas, project monitoring and consumer retail activity.

The sub-categories of Satellite & Weather Data include:

- Satellite Data

- Weather Data

Learn More About Alternative Data

Remember, to learn more about each alternative data category, please click on the title of each alternative data category. On each alternative data category page, you can explore detailed insights, the data structure that you can expect from the respective category, compliance considerations with links to interesting compliance reports and blogs, and relevant content within each alternative data category.

If you would like to learn more about alternative data trends from 2023 and our outlook on the alternative data space for 2024 and beyond, you can download our annual Alternative Data Report.

If you would like to learn more about Eagle Alpha’s compliance, data buyer, or alternative data provider offerings, please reach out and you can request a demo of our offerings here.