Alternative Data For Private Equity

While the buyside has been the most prominent user of alternative data since 2012 – since 2017, Eagle Alpha has been actively working with data-driven private equity firms that are keen to integrate alternative data into their established investment processes. This approach signifies a new frontier in investment strategy, where conventional methods are augmented by rich, diverse datasets.

In an environment of softer valuations, alternative data becomes a key tool in identifying lucrative buying opportunities. By leveraging nuanced market data, private equity firms can pinpoint undervalued assets and emerging market segments. In this domain, private equity firms often opt for annual subscriptions with data vendors. This continuous stream of data provides a robust foundation for identifying and assessing potential investment opportunities, a crucial edge in the competitive world of private equity.

This article reviews the three common applications of alternative data for private equity: deal origination, due diligence, and portfolio monitoring. We further demonstrate and assess the use of alternative data for these processes, by highlighting five alternative data providers who shared their expertise on Eagle Alpha’s webinar in December 2023. For more information on alternative data for private equity, get a demo of our platform here.

Deal Origination

Private equity firms are increasingly looking to data and technology to assist with deal origination. New data and technology have led to the rise of machine learning and data-centric private equity firms. Innovative private equity funds like San Francisco-based CircleUp and Sweden’s EQT use machine learning to originate deals, having a definite impact on successful portfolios.

The key focus in deal origination is still centered on developing human relationships with owners and entrepreneurs; the machines are used to augment humans. Alternative data can provide insights ahead of any access to management information, allowing diligence to start earlier in the process. Generative AI and ChatGPT have also had an impact recently with more private equity firms experimenting with these tools.

Private equity firms are seeing increased efficiencies. As Jessica Ginsberg, Managing Director at LFM Capital, explained: “If a source servicing provider can boil the ocean for me and identify 100 targets that we feel really good about and I can get emails out to those people in 24 or 48 hours versus the olden days, the vault, the volume, and the velocity that these tools can bring to deal sourcing is tremendously valuable.”

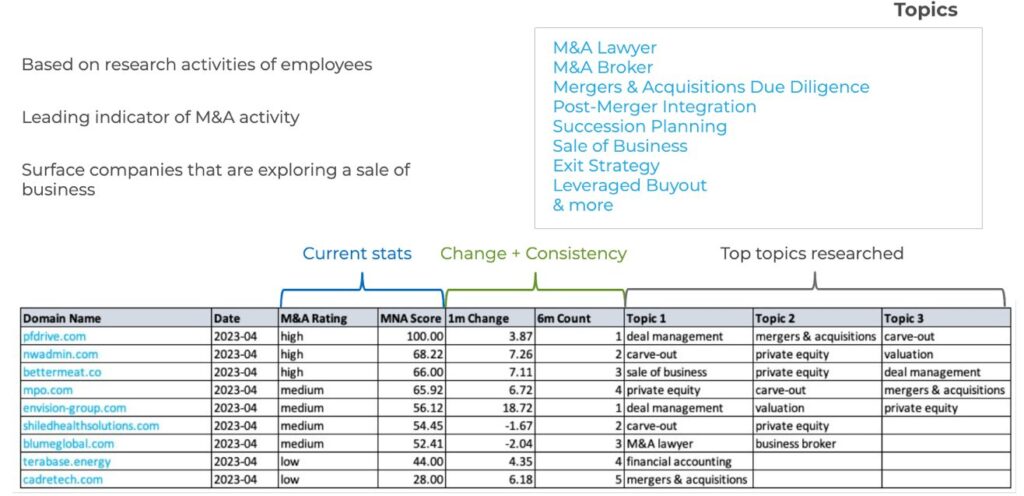

Fintent was one of the presenters who focused on generating signals for private companies. They collect from various data sources, including website scraping and financial content analysis, to cover demographics, company growth, and more. One of their key products is an M&A score for deal origination, illustrated in Figure 1 below, which is based on the research activity of employees. This score helps investors identify potential M&A targets and trends, providing crucial insights for private equity firms.

Figure 1: M&A Score for Deal Origination (Source: Fintent)

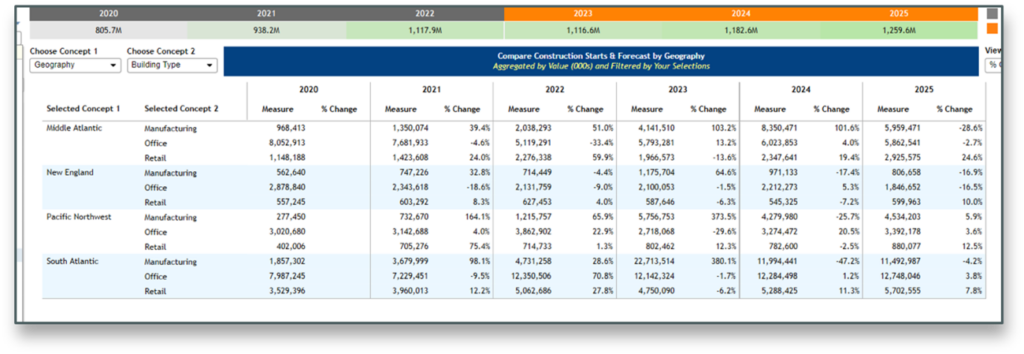

Data provider, Dodge Data, focuses on the construction industry in the United States, offering research based on individual construction projects. They provided a case study on a building product manufacturer, illustrating how they helped the company identify growth opportunities in manufacturing. Their approach includes sizing the market, assessing target positioning, and identifying key players in the industry.

Their data on specifications, architects, and owners provide a comprehensive view of the construction market, essential for private equity firms evaluating investment opportunities in this sector. Figure 2 below shows that retail and offices are no longer areas for growth but provide enough volume to remain a focus. Manufacturing, on the other hand, represents high growth with approximately a 200% increase for neighboring South Atlantic and Pacific Northwest.

Figure 2: Construction Starts & Forecast by Geography (Source: Dodge Data)

Due Diligence

The due diligence process often involves credit-based agreements, where speed and accuracy are paramount. An example cited in the webinar is the use of web traffic data to correlate with revenue trends, offering a rapid, data-driven assessment of a company’s financial health and market position.

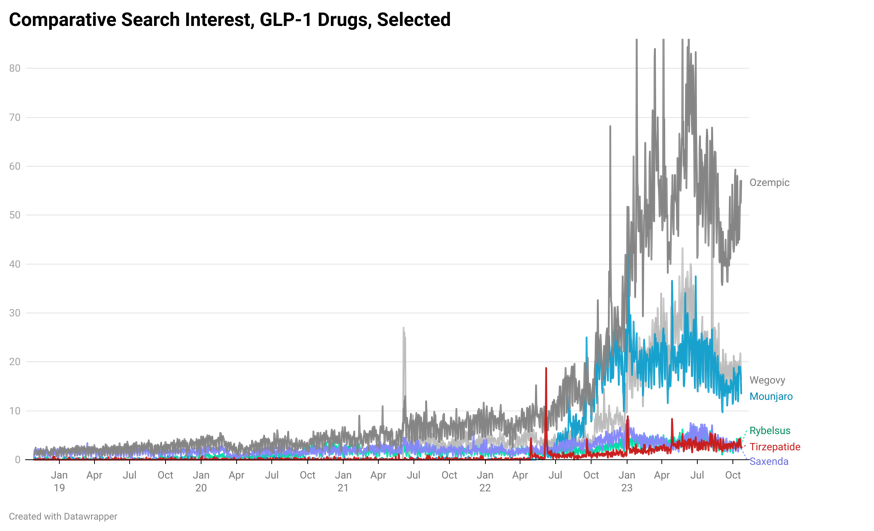

Babel Street Data, formerly known as Vertical Knowledge, offers extensive web data collection services, utilizing a significant infrastructure of controlled, non-residential IPs. They focus on collecting and caching web pages to fill in information gaps and provide deeper insights. Their approach to trend and intent data analysis helps understand customer engagement and market trends at a granular level. They also discussed how this data can be used for due diligence and identifying emerging brands, providing valuable information for private equity firms. Figure 3 below shows how Babel Street Data analyzes comparative search interest for various drugs. Four search terms (Rybelsus, Mounjaro, Saxenda, and Tirzepatide) are shown in color in comparison to the leading search terms (Ozempic and Wegovy) in shades of grey.

Figure 3: Comparative Search Interest for Various Drugs (Source: Babel Street Data)

Portfolio Company Monitoring

For ongoing portfolio management, alternative data proves invaluable. Tools such as social media listening provide private equity firms with insights into consumer trends and market dynamics, enabling them to make informed decisions about their current investments. A significant trend is the monetization of data assets within portfolio companies. As a company, we emphasize the role of private equity funds in realizing the potential of aggregating data assets across multiple portfolio companies. This collective approach not only enhances the value of individual datasets but also serves as a key indicator of demand-side opportunities in the market.

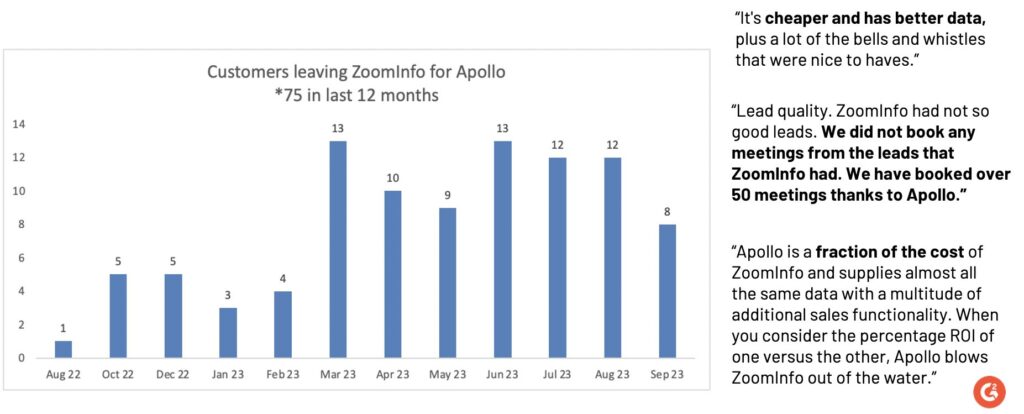

G2, a leading review platform for B2B software, shared a case study on Apollo, a software company with a valuation of $1.6 billion. The platform’s review data and buyer intent data provided insights into Apollo’s journey from a small tool to a significant market disruptor, competing with large companies like Zoominfo. G2’s approach involves analyzing user comparisons and sentiments to identify trends in product innovation, market positioning, and competitive landscape, demonstrating how private equity firms can leverage such data for informed decision-making. Figure 4 below shows an example of qualitative analysis for Apollo.

Figure 4: Qualitative Insights for Apollo.io (Source: G2)

They also highlighted that private equity firms are doubling down on their investments, getting more involved with their portfolio companies to ensure successful outcomes. There’s also a trend of conversations about raising new funds in 2024, pointing to a positive outlook in the sector.

Conclusion

As the private equity landscape continues to evolve, the use of alternative data is expected to play an increasingly pivotal role in driving successful outcomes and maintaining a competitive edge in the industry. For more information on alternative data for private equity, get a demo of our platform here.