Nowcasting Economics is Increasingly Used by Investment Analysts and Central Banks and Seen as a Driver for Alternative Data Adoption

Background

Nowcasting economics refers to the process of estimating current or near real-time conditions using various data sources. This is in contrast to traditional economic indicators that are released with a delay. Real-time monitoring of macroeconomic conditions has become a focus for central banks, government agencies, and corporates as surprising data releases can often trigger market shifts.

One notable application of alternative data has been in tracking retail performance during COVID-19 and the period of increased volatility. In early 2020, when companies ceased providing guidance, investors turned to alternative sources as a more reliable indicator of retail performance. This proved invaluable for gaining macro insights as the economy faced unprecedented challenges and uncertainties.

In February 2022, we hosted a virtual data conference where one of the panels was dedicated to nowcasting about inflation, lockdowns, and consumer trends. The speakers noted the trend towards higher frequency inputs into macro models. Seth Leonard, a Data Scientist at System2, highlighted that high-frequency data such as employment figures, restaurant bookings, and mobility data are being used to predict lower-frequency indicators such as inflation and industrial production. Higher frequency datasets might only have 2-3 years of history. These can be difficult to model as macroeconomic analysis would require at least 10 years of data if not more. Having data related to at least one economic cycle would be ideal.

Another important consideration with alternative data is the variation in data frequency. How to combine daily/weekly/monthly data into a nowcast or forecast where the frequency is a slower moving quarterly or annual requirement. This report highlights the latest trends, academic research, and leading alternative data vendors that help nowcast economics indicators.

Latest Nowcasting Economics Trends

The UK Office for National Statistics (ONS) mentioned in its May 2019 release that it had an ambitious plan to implement web scraped and point-of-sale scanner pricing data in the production of aggregate measures of consumer price statistics by 2023. In March 2023, ONS published its consumer price statistics, including rail fares transaction data from Rail Delivery Group.

The outlined changes are part of an ongoing effort to enhance consumer price statistics, aiming to incorporate new data sources for various categories and further improve these statistics in the upcoming years. Emphasizing quality, decisions regarding timelines are contingent on system development, research, and impact analysis, with continuous engagement with stakeholders and users.

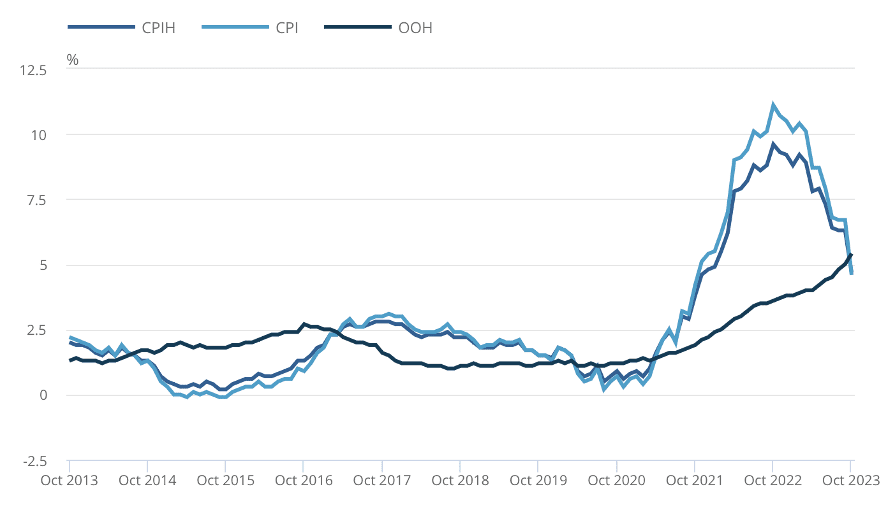

In Q1 2024, the plan involves integrating web data for second-hand cars and administrative microdata on private rents for Great Britain. These additions will impact indices like the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI). Further developments include incorporating grocery scanner data for food and non-alcoholic beverages, alcohol, and tobacco in Q1 2025. The latest nowcasts are presented in Figure 1 below.

Figure 1: CPIH Fell to Lowest Level Since November 2021 (Source: ONS)

It is interesting to note that the Bureau of Labor Statistics is also considering using alternative data in the construction of the US Consumer Price Index. The New York Fed Staff Nowcast, introduced in April 2016, stands as another example of nowcasting utilizing big data. Employing Bayesian estimation and Kalman filtering within a dynamic factor model, the platform adopts a robust big data structure to capture essential characteristics of macroeconomic data dynamics efficiently.

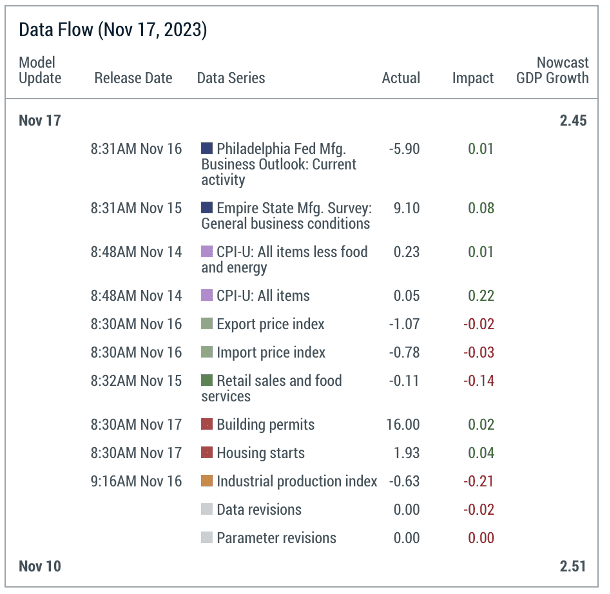

This approach formalizes the traditional process used by market participants and policymakers for forecasting, involving the continuous monitoring of multiple data releases, shaping expectations, and adjusting assessments of the economy when actual facts deviate from anticipated outcomes. Furthermore, it’s engineered to process incoming data akin to “news,” mirroring the mechanisms observed in market behavior. Figure 2 below shows the impact of data releases on the overall GDP nowcast.

Figure 2: Impact of Data Releases (Source: Federal Reserve Bank of New York)

Two Relevant Case Studies from Alternative Data Providers

Case Study 1 – ClearMacro

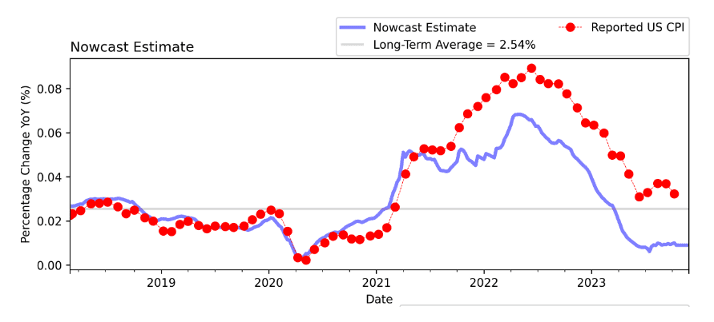

ClearMacro makes available daily nowcasts for GDP, OECD Lead Indicators, and CPI for a broad range of countries. Integrated to a tactical investment signal library, the platform does the heavy lifting for clients by solving a range of pre-processing data complexities (such as ensuring point-in-time inputs and outputs, mixed data frequencies and different data availability across countries) to ensure that models are driven by a richly diversified set of underlying public and alternative data sources across regions, countries, and industries. Figure 3 below shows that the US CPI nowcast caught the reversals higher in 2020-2021 and lower in 2022-2023.

Figure 3: US CPI Nowcast (Source: ClearMacro)

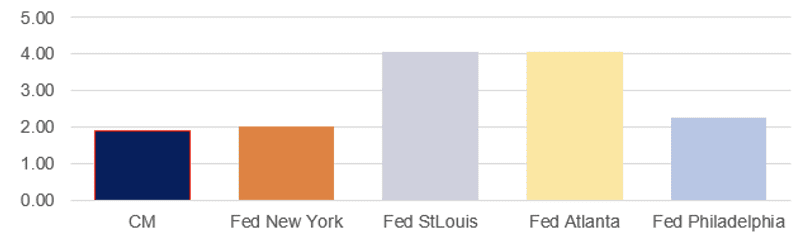

Back tests of ClearMacro nowcasts demonstrate superior relative accuracy compared to publicly available comparators such as GDP nowcasts provided by various US Federal Reserve banks. Figure 4 below shows mean absolute errors with data from Q1 2002 to Q4 2020.

Figure 4: Mean Absolute Errors (Source: ClearMacro)

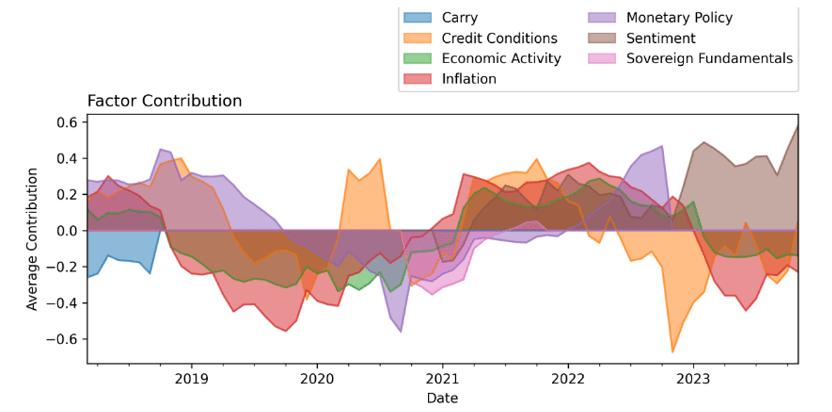

ClearMacro believes that being able to explain changes in nowcast levels is as important to use case credibility as accuracy statistics. As such, the platform provides several visualization options (at a range of information granularity) for nowcast drivers and the underlying metadata on a customer API. Figure 5 below shows that whilst most data categories are currently negative drivers, sentiment data is a significantly positive component of the current US GDP nowcast of 2.2% p.a.

Figure 5: Sentiment Data a Positive Driver (Source: ClearMacro)

Case Study 2 – i360

i360’s data science team builds unique models for inflation series at a very granular level (e.g. potatoes, vet services). Their custom algorithm searches for and builds models for all series. The process involves comparing numerous individual models to identify the most promising ones. They primarily utilize Seasonal ARIMA and exogenous variable models for their interpretability. Additionally, specific high-value models are fine-tuned manually, focusing efforts where additional value can be generated. Finally, the results from these models are weighted and combined to create more advanced models at a higher level.

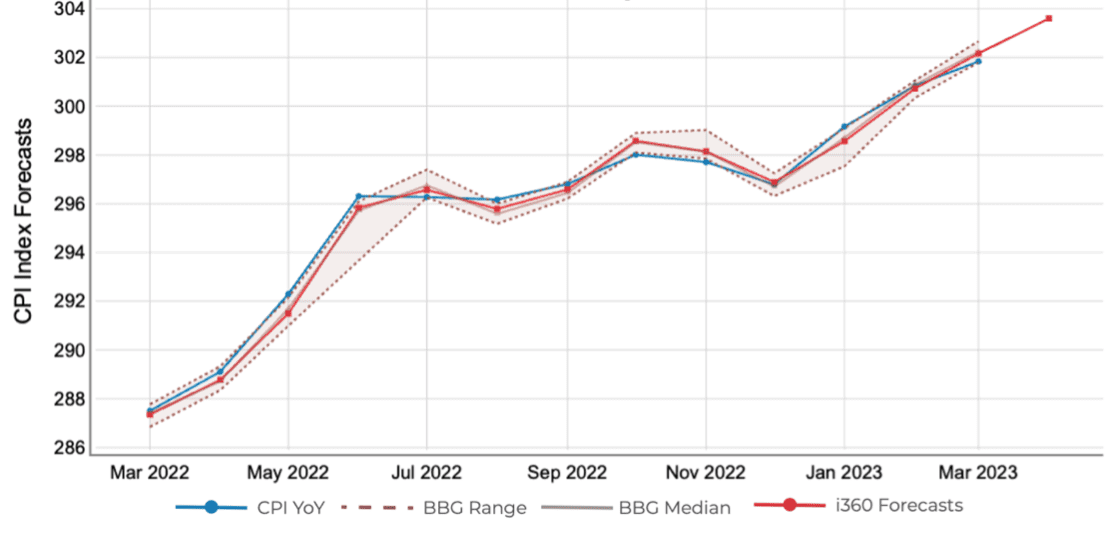

Figure 6: i360 Forecast Comparison vs. Bloomberg (Source: i360)

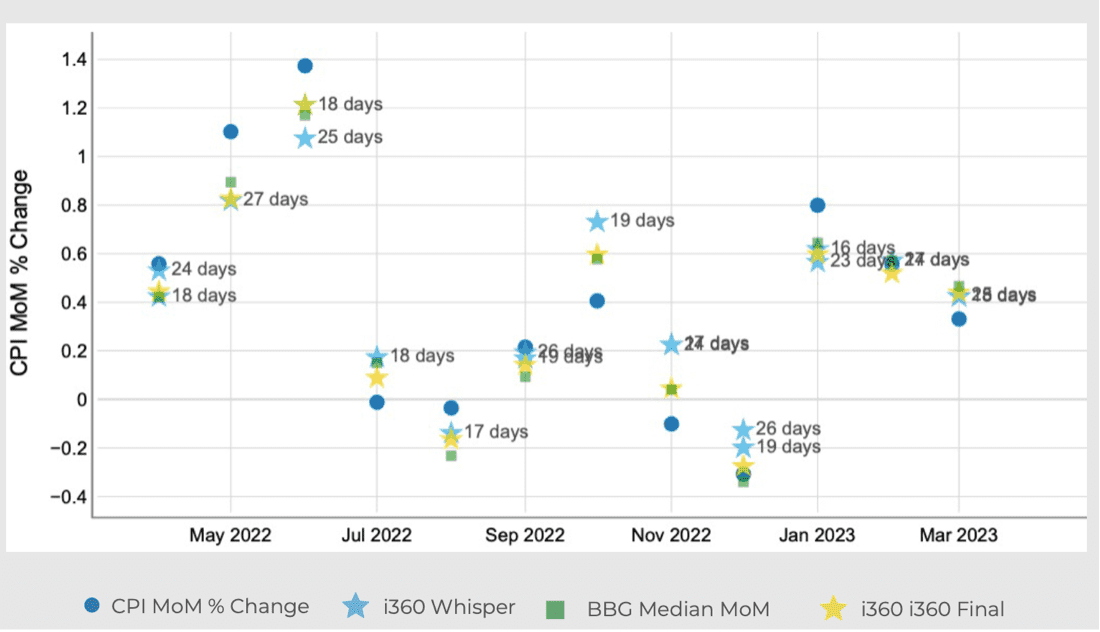

I360’s forecasts change over the course of the month and a half until print, but initial numbers come out well over a month before most Bloomberg estimates are posted. They also deliver Whisper numbers that show the performance of i360’s early forecasts (defined here as reports 2 to 4 weeks ahead of CPI release) compared to the actual outcome. Results are very close to both the Bloomberg median estimate released 1-2 days before the CPI release and the actual release date.

Figure 7: i360 Whisper Forecasts vs Bloomberg Estimates (Source: i360)

Conclusion

Nowcasting economics has gained prominence in recent years, especially during volatile economic periods like the COVID-19 pandemic when traditional indicators faced disruptions. The integration of alternative data sources, advancements in modeling techniques, and the continuous pursuit of improving accuracy and interpretability continue to enhance the effectiveness of nowcasting.