As the use of alternative data becomes central to the alpha generation process, buyside firms are investing heavily in building out their data infrastructure. At the heart of this transformation lies the data sourcing function.

As the use of alternative data becomes central to the alpha generation process, buyside firms are investing heavily in building out their data infrastructure. At the heart of this transformation lies the data sourcing function.

Originally released in August 2024 as part of our premium client content, we’ve just made this in-depth regional report publicly available for the first time. It explores the evolving alternative data ecosystem in Japan and how global investors are increasingly tuning into new signals in the region.

Inside the report:

🔹 Case studies on data from Honda, Fast Retailing, and more

🔹 Insights on Japan’s digitization and data infrastructure challenges

🔹 Growth drivers behind the local alt data market and the role of JADAA

🔹 Detailed vendor profiles and dataset applications

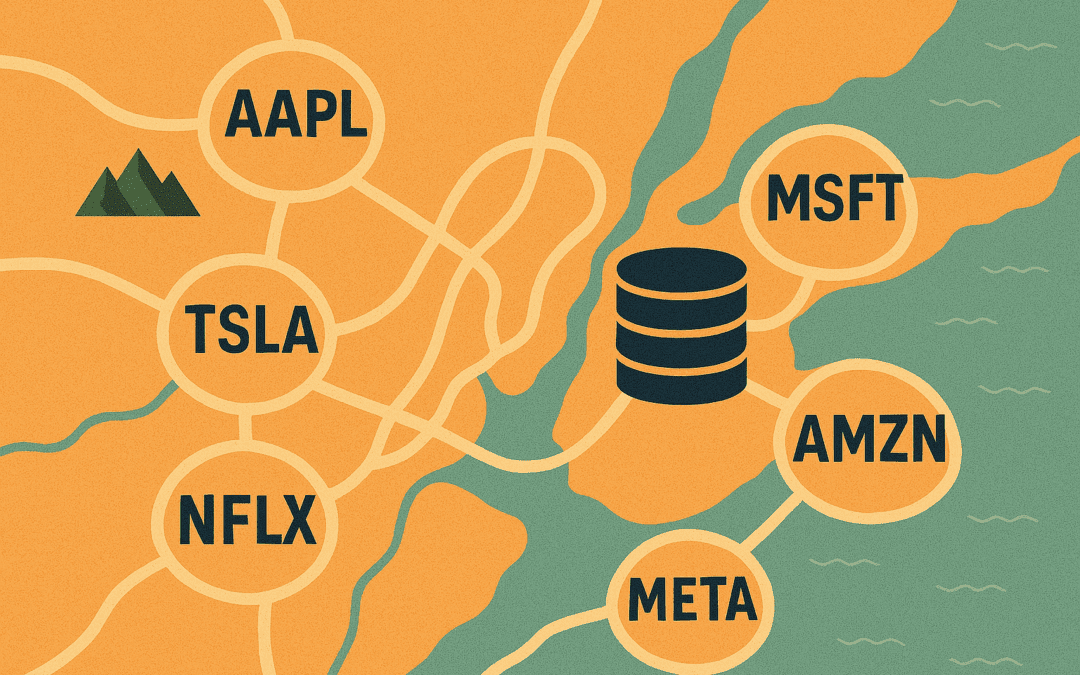

Learn effective strategies for mapping data to correct identifiers, symbols, & tickers, ensuring data accuracy & integration across platforms.

In this report, we discuss India’s strong economic growth, supported by infrastructure projects, higher incomes, and important policy changes. We also look at how the financial system is changing, including the stock market, private investments, and growing interest from hedge funds. The fast-growing fintech industry and the rise of alternative data are also covered. Finally, real-world case studies featuring various alternative data vendors are showcased, followed by comprehensive vendor comparison matrices to aid in evaluation and decision-making.

Eagle Alpha’s Alternative Data Conference in New York on February 12, 2025, brought together industry leaders, investors, and data providers for a day of in-depth discussions on the evolving alternative data landscape. The conference covered key themes, including the increasing regulatory scrutiny on AI and alternative data usage, insights into hedge fund technology, and the role of data in private equity. A summary of key private equity panels is presented below.

Eagle Alpha’s Alternative Data Conference in New York on February 12, 2025, brought together industry leaders, investors, and data providers for a day of in-depth discussions on the evolving alternative data landscape. The conference covered key themes, including the increasing regulatory scrutiny on AI and alternative data usage, insights into hedge fund technology, and the role of data in private equity.

Selling your data to asset managers can be a profitable venture. Understanding how to market your data effectively and set appropriate pricing is crucial to sell data. This guide provides practical advice on these aspects.

The Unbound Alternative Data Conference was held on October 9th at Convene’s Madison Avenue offices. The agenda included talks from experts in the fields of AI and data strategy, new-to-market vendors showcasing innovative datasets and fresh features, Q3 trends from category leading vendors, B2B technology, and compliance updates.

Short interest data serves as a critical indicator of market sentiment, with high short interest suggesting bearish outlooks and low short interest indicating bullish perspectives. Utilizing strategies that leverage this information, such as going long on low short-interest stocks and short on high short-interest stocks, can potentially enhance portfolio performance. However, managers must be cautious of crowded trades and the potential for short squeezes, which can lead to rapid price increases.

Discover how alternative data can be used to gauge insights about congressional trading and legislative lobbying