From Trends to Trades: How Alternative Data is Shaping Tech Stock Assessments

Background

Investing in technology involves unique challenges and opportunities. The sector often commands higher valuations, reflecting its above-average growth potential. Yet, even unprofitable tech companies can hold huge valuations, demanding careful consideration of company details, product offerings, and competitive landscapes. Technology companies are also associated with continuous innovation and considerable expenditures on R&D projects.

In 2020, technology stocks surged during the COVID-19 pandemic, with NASDAQ Composite gaining 43.64% and outperforming the broader S&P 500. Lockdowns boosted tech purchases for remote work, and low-interest rates increased tech stock valuations. After Joe Biden’s election, optimism grew for economic recovery due to unprecedented stimulus leading to concerns over rising inflation. This pushed longer-term bond yields higher, impacting markets. By 2022, the NASDAQ was in the decline, indicating investors shifting away from tech stocks.

Several hedge funds, including Tiger Global Management, D1 Capital Partners, and Coatue Management, increased their investments in startups, benefiting from high valuations and a hot IPO market in 2021. However, the subsequent year saw record losses for some hedge funds. As the startup landscape evolved, focus shifted to 409a valuations – internal assessments determining common stock prices. Many unicorns faced a new reality as they grappled with adjusting their valuations.

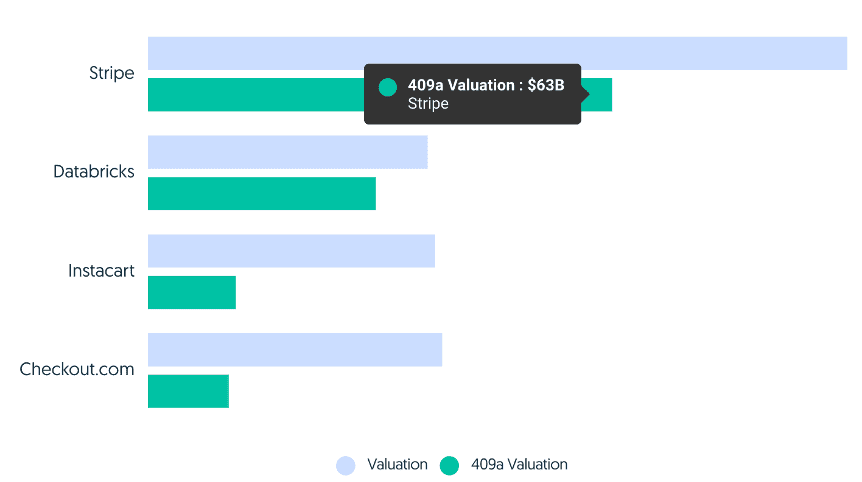

Figure 1 below shows that Checkout.com, for instance, saw a staggering 73% drop in its internal valuation to $11 billion, merely months after a $1 billion funding round valued it at $40 billion. Similarly, Instacart’s internal valuation plummeted by 69%, and fintech giant Stripe lowered its valuation by 40% within six months. The same trend can be observed in India with the valuations of unicorns like Paytm and Zomato taking substantial hits.

Figure 1: Companies’ Funding Round Valuations Vs. Most Recent 409a (Source: Crunchbase)

Tech stocks have recovered so far in 2023. Tiger Global rose 6.5% in May 2023 bringing the fund’s year-to-date return to 15.5%. Similarly, Whale Rock Capital Management’s public equity portfolio returned 14.4% in May, resulting in a year-to-date return of 23%. These gains were driven by the market’s enthusiasm for generative artificial intelligence, benefiting technology shares overall.

This article has been redesigned from research as part of Eagle Alpha’s Navigator platform which provides in-depth analysis into data vendors and case studies using alternative data. For more information on how to access these full reports, please email dallan.ryan@eaglealpha.com.

Tech Trends

During Q4 2022, the technology sector experienced hiring freezes and layoffs, a response to earlier aggressive hiring during boom years and post-pandemic stimulus. As leaders seek to align their workforces, the challenge of recruiting and retaining skilled personnel persists, with 58% of surveyed tech decision-makers facing recruiting difficulties and 48% grappling with retention issues. Smaller tech firms may benefit from the workforce reductions as they can acquire available talent.

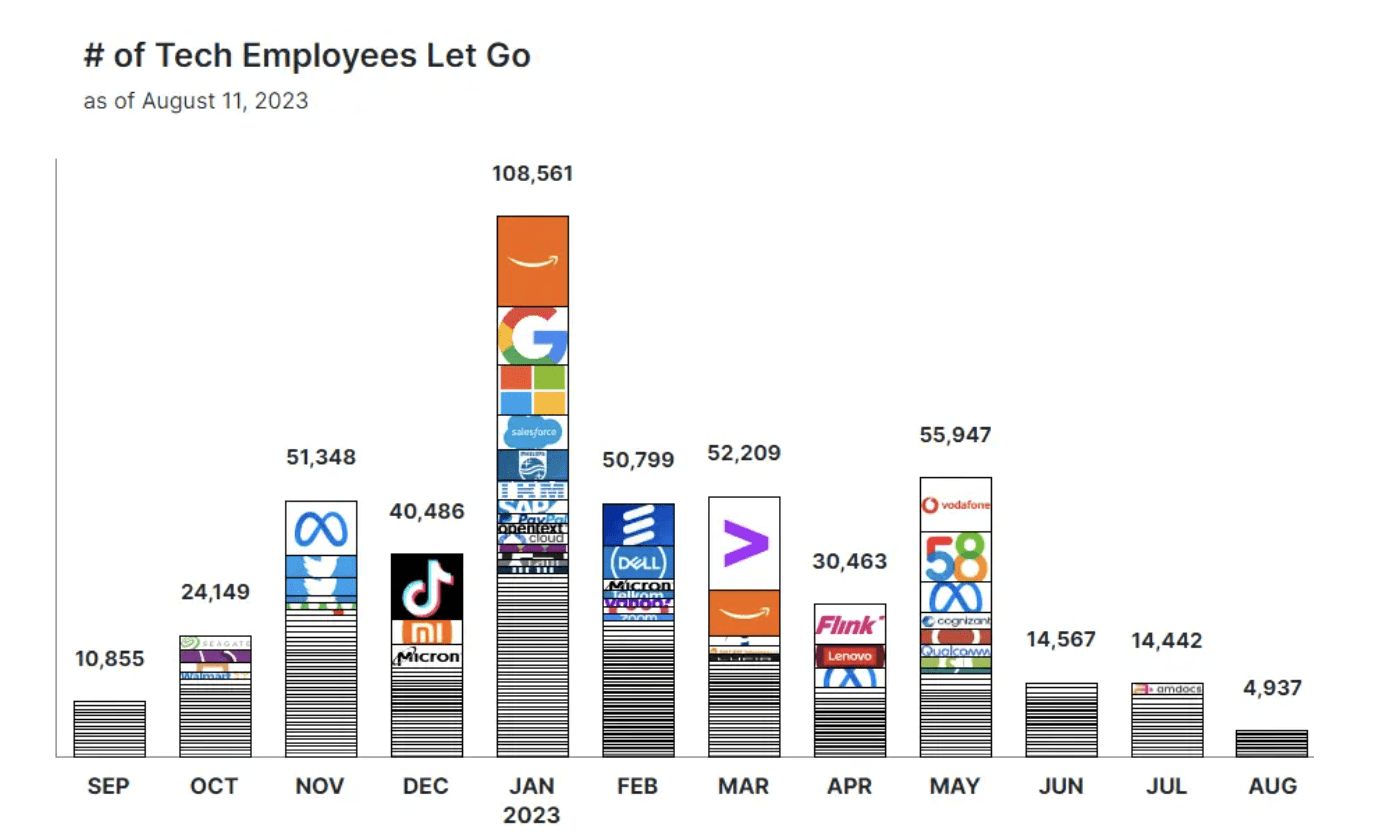

In August 2023, the analysts from Bernstein Research published a note retiring their monthly data series tracking layoffs as job cuts in the tech sector have significantly slowed down. The most recent data showed 4,937 job cuts in August (see Figure 2 below), suggesting a monthly estimate of around 11,000 layoffs. This marks a notable decline from the earlier part of the year when over 300,000 tech jobs were lost in the first half, averaging around 51,000 losses per month.

Figure 2: Monthly Job Cuts Across the Tech Industry (Source: Bernstein Research, Trueup.io)

AI-driven innovation, particularly the growth of AI startups and their hiring of engineers and specialists, has played a role in limiting the impact of job cuts. Many large tech companies have also ceased layoffs and have even begun rehiring employees they had let go earlier. This shift has led Bernstein analysts to declare the end of the “Tech Job Recession” and poses the question of when hiring will pick up again in the industry.

Tech giants are diversifying into various industries to seek new growth opportunities amid macroeconomic pressures. The health care sector, for example, is ripe for innovation and digital transformation. Alphabet and Amazon are investing billions in health care venture capital. Transformations driven by technology extend beyond health care to include automotive advancements like autonomous driving, real estate IoT and energy optimization, manufacturing’s smart factory solutions, and immersive retail experiences through augmented reality and 3D technologies.

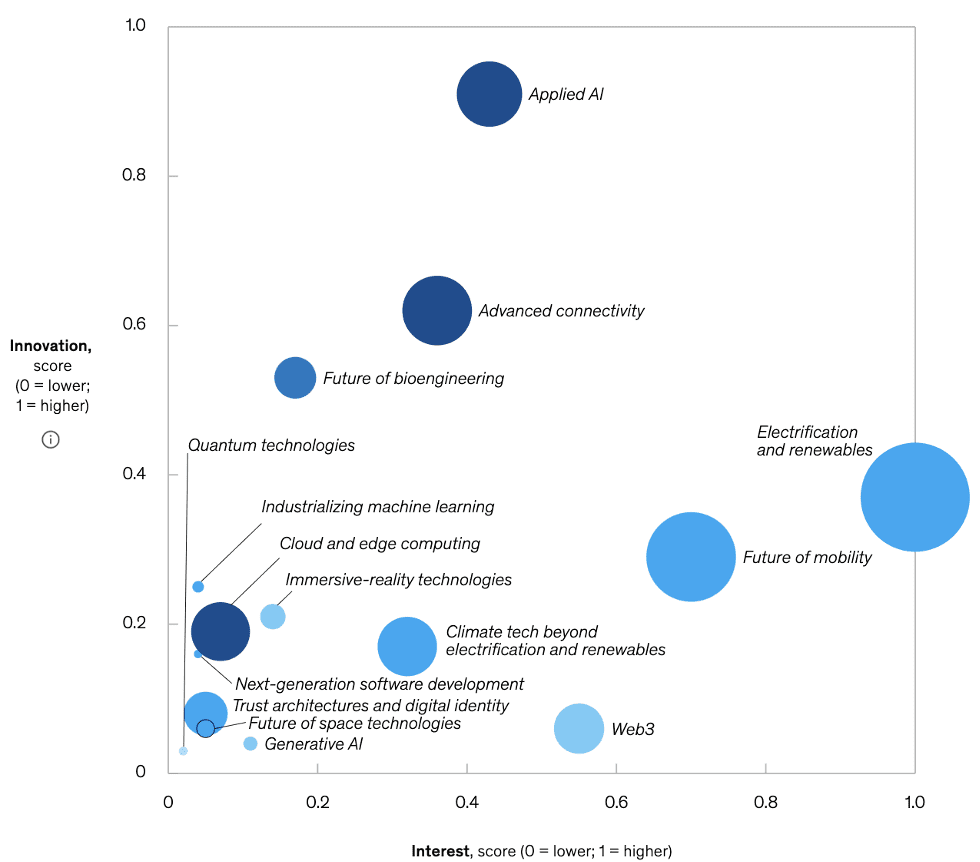

Figure 3 below shows the 15 main tech trends according to McKinsey, organized into five overarching categories: the AI revolution, building the digital future, compute and connectivity frontiers, cutting-edge engineering, and a sustainable world. The report assesses the state of each trend using innovation scores based on patents data, as well as interest scores derived from news and web data. Additionally, investments in relevant technologies are considered, and the level of adoption by organizations is rated.

Figure 3: McKinsey Technology Trends Outlook 2023 (Source: McKinsey)

Alternative Data Availability

In the age of data-driven decision-making, various data sources have emerged as valuable tools for analyzing tech stocks.

Online reviews, prevalent on social media and various platforms, shed light on customer sentiment, with positive reviews often correlating with rising sales and excessive negative feedback potentially indicating poor management. Moreover, app reviews particularly underscore user satisfaction, like in mobile banking services.

While social media offers real-time sentiment, direct consumer surveys illustrate the reasons behind these sentiments. For accurate investment decisions, it’s crucial to cross-reference social media trends with these surveys, ensuring a comprehensive understanding free from the potential noise of social platforms. On the B2B front, surveys collect insights from professionals about their tech needs, preferences, and challenges, covering aspects from software choices to satisfaction with existing tech solutions.

Data from daily job postings, categorized by company and often accompanied by ticker symbols, provides a window into company operations and growth. These postings, sourced from corporate websites or job boards, encompass various attributes like job titles and descriptions, giving investors a peek into the company’s fundamentals. Web traffic and app usage data are pivotal for tech companies. The former reveals user browsing behaviors, from site visits to purchase intentions, while the latter dives deep into how users interact with apps, from feature usage to device details.

Understanding a tech company’s robustness also involves examining supply chain data. Firms with diverse suppliers and sound partnerships exhibit resilience against potential disruptions, be it geopolitical events or component shortages. This data delineates costs spanning production to warehousing. Patent data serves as an innovation barometer. Companies with a rich patent portfolio are often poised for commercial triumphs, and this data, complete with inventors, claims, and patent history, provides foresight into a company’s potential growth.

Furthermore, the ever-expanding realm of the Internet of Things (IoT) churns out colossal data streams. Devices, often sensor-equipped, provide actionable insights, automating processes and enhancing monitoring capabilities. Lastly, technographic data, detailing the technological arsenal of businesses from software to IT services, delivers an exhaustive view of a company’s tech stack, directly influencing its industry standing and growth potential.

For more information on the data sources mentioned in this article and recommended third-party data providers available to view on our buyer platform, please reach out to dallan.ryan@eaglealpha.com.

Conclusion

The technology sector’s allure lies in its potential for above-average growth, driven by continuous innovation and evolving consumer demands. However, this potential is not without risks, as evidenced by the volatility observed in tech stocks. Various sources of data, from social media sentiments and survey data to job postings and transaction data, can be leveraged to gain insights into company performance, industry trends, and customer sentiments.