Unlocking Investment Potential in Healthcare: The Role and Impact of Alternative Data

Background

The roots of Pharma and Biomed investments can be traced back to the 1980s, marking the era when biotechnology burst onto the scene. Groundbreaking strides in genetic engineering set the stage for trailblazing companies like Genentech and Amgen to set foot in the market. Following their lead, funds such as Kleiner Perkins broadened their portfolio, closely associated with esteemed institutions like Stanford University and UCSF medical centers.

As the potential of healthcare investments began to unfold, venture capital firms shifted their focus and channeled more resources into this flourishing sector. The advent of the human genome sequence sparked an increased fascination and investment in personalized medicine and biotech. The early 2000s saw an influx of funding and scientific advancements, punctuated by high-profile IPOs of key players such as Alnylam and Momenta.

Industry expert Bruce Booth, a partner at Atlas Venture, acknowledged that the industry landscape has undergone a remarkable metamorphosis despite early IPOs often falling below the private investor cost basis. A noteworthy shift was observed in the 2010s with a surge of 50% in post-money valuations for preclinical and Phase 1 projects.

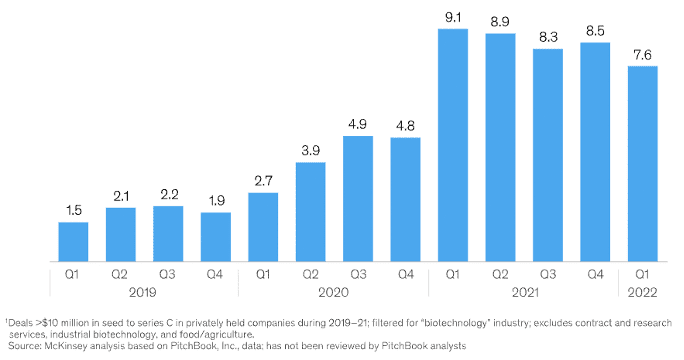

The graph (Figure 1) by McKinsey underscores the peak in venture capital biotech funding in the first quarter of 2021, revealing the potential unleashed by the COVID-19 crisis for further scientific advancements. The depth of healthcare equity markets has expanded significantly, with mutual funds, hedge funds, and sovereign wealth funds, including notable entities like Point72, Fidelity Biosciences, OrbiMed Advisors, and Venrock, rolling out healthcare-specific initiatives.

Figure 1: Capital Raised by Privately Held Biotech Companies at Seed to Series C, total investments in billions of USD (Source: McKinsey)

In just two years (2019-2021), VC companies globally pumped more than $52 billion into therapeutic-based biotech companies, with a significant chunk dedicated to start-ups armed with platform technologies. The investment pattern suggests a strong inclination towards ground-breaking technologies capable of delivering personalized treatments to patients with enhanced precision. Precision medicine serves as a perfect example, offering the ability to diagnose conditions sooner and providing tailored therapies aligned with patients’ unique genetic profiles.

This article has been redesigned from research as part of Eagle Alpha’s Navigator platform which provides in-depth analysis into data vendors and case studies using alternative data in the healthcare and pharma space. For more information on how to access these full reports, please email dallan.ryan@eaglealpha.com.

Alternative Data Availability

The growing wave of alternative data sources is drastically reshaping the healthcare industry. This alternative medical data, stemming from various non-traditional sources like patient-generated data, wearables, mobile health apps, health-related social media discourse, and electronic health records (EHRs), offers healthcare professionals and researchers invaluable insights into real-time patient health statuses, behaviors, and treatment outcomes.

Reza Khorsidi of the University of Oxford’s Deep Medicine program lauds the progress made with alternative medical data, noting the increasing utilization of such data in research studies for generating compelling medical evidence. A shift towards these new data sources can indeed unravel significant associations, such as the connection between daily step count or push-up count and overall mortality or cardiovascular mortality, respectively.

For the purpose of this article, let’s zoom into four sub-categories of healthcare data: 1) R&D and clinical trials; 2) claims data; 3) medical devices data; and 4) other related datasets.

R&D and Clinical Trials

Data collected during R&D and clinical trials offer investors crucial insights into a new drug or treatment’s potential success. However, numerous factors can impact the trial’s outcomes and conclusions. These include patient recruitment and compliance, study design, funding availability, regulatory environment, and unforeseen challenges.

Claims Data

Claims data, generated from medical claims and billing processes, provides valuable insights into patient diagnoses, treatments, procedures, and medication use. Despite the challenges of accessing claims data in the EU due to privacy regulations, data fragmentation, and lack of standardized coding systems, it proves invaluable in gauging market size for specific medical conditions or treatments, analyzing treatment patterns, and optimizing financial strategies among other uses.

Medical Devices Data

Data relating to medical devices inform about their design, performance, safety, efficacy, and market trends. Such data facilitates the assessment of the competitive landscape within the medical device industry, allowing for informed decisions about product development, marketing strategies, and investment opportunities.

Other Datasets

Beyond these, other alternative datasets offer crucial insights. Platforms like Bluedot Infectious Diseases track the global activity of over 150 infectious diseases, providing real-time data on disease outbreaks, transmission patterns, and geographic hotspots. LendRx DolTracker presents an overview of over 13,000 therapeutics at various stages of research, development, or early launch stages connected to over 3,500 companies, keeping investors and analysts up to date with the latest sector developments.

As alternative data sources continue to flourish, the opportunities for personalized medicine, disease management, population health, and investment in the healthcare and pharma sectors are likely to expand correspondingly.

Compliance Considerations

For funds and healthcare organizations, adhering to various laws, regulations, and standards is non-negotiable. Ensuring the protection of patient data is essential to avoiding legal and financial backlash. A key consideration for healthcare investments involves compliance with anti-fraud and abuse laws, such as the U.S. False Claims Act, the Anti-Kickback Statute, and the Physician Self-Referral Law. Beyond these, investors need to be conscious of laws like the Health Insurance Portability and Accountability Act (HIPAA) in the United States, the General Data Protection Regulation (GDPR) in the European Union, and other pertinent data protection regulations globally.

HIPAA serves as a benchmark for protecting sensitive patient data. All “covered entities”, including healthcare providers, health plans, and healthcare clearinghouses, are required to implement comprehensive safeguards to maintain the confidentiality, integrity, and availability of patient information. This extends to the use, storage, and transmission of data and employee training on data security.

Sharing patient data with third-party entities, such as research institutions or tech vendors, demands careful consideration. Therefore, establishing clear data-sharing agreements is imperative and should detail the purpose of data sharing, security measures in place, responsibilities of each party, data retention period, and procedures for data deletion or destruction once the purpose of data sharing has been met.

Consumer health data has become a contentious topic. Recent FTC cases involving Premom, GoodRX, and Flo have spurred discussions and legislative actions in Washington and Connecticut to provide enhanced protections for consumer health information. The International Association of Privacy Professionals (IAPP) has proposed adopting different tiers categorizing health data based on risk sensitivity and its combination with other data sources.

AI use in the healthcare and pharma sectors is also under active consideration. Outside of the US, on June 14th, 2023, the EU Parliament approved its draft AI Act. It classifies products and services by risk levels, determines operator obligations, and establishes harmonized rules for deployment and market monitoring of AI systems. This draft AI Act holds several implications for the pharmaceutical sector, including aspects like medical devices, biometric categorization, generative AI systems, and data privacy and protection issues when AI is employed in clinical trials.

While the compliance landscape for healthcare and pharma investments might appear challenging, a well-informed approach that understands the role and regulations around alternative data can lead to significant benefits.

This article has been redesigned from research as part of Eagle Alpha’s Navigator platform which provides in-depth analysis into data vendors and case studies using alternative data in the healthcare and pharma space. For more information on how to access these full reports, please email dallan.ryan@eaglealpha.com.

Conclusion

In conclusion, alternative data and AI are revolutionizing the healthcare and pharma sectors, improving efficiency in drug discovery and development. Yet, these advancements bring challenges in data accuracy and patient privacy that industry professionals must tackle.

The compliance landscape, shaped by regulations like HIPAA, GDPR, and new frameworks like European Health Data Space (EHDS), is becoming more complex, making data protection a priority for all stakeholders. As the sector continues to evolve, healthcare organizations and investors must stay updated with these regulatory changes. The ability to balance innovation with compliance will be key in fully harnessing the potential of AI and alternative data, leading to more effective patient care and improved clinical outcomes.