Economic Trade: Breaking Down Trends With Alternative Data

Eagle Alpha will return to New York on June 6th for its second alternative data event of the year. As always, they will be bringing along the top minds of the industry and have added features that both buyers and vendors have acknowledged are the most important for the day’s success including a compliance hub, as well as a data incubator and corporate data area. Register your interest to attend here.

Background

In today’s globalized world, economic conditions are constantly changing. That is why accurate and early forecasts of global trade flows can provide a good read on economic activity both at the macro and micro levels. Alternative datasets can be used to analyze trade patterns, track the movement of goods and services across borders, and measure the economic impact of trade policies and agreements. Interestingly, the demand for alternative datasets has surged since the outbreak of COVID-19 as investors were looking for new ways to monitor disruptions and recovery of supply chains.

Economic trade datasets contain information on the size of specific commodities, volume, mode of transportation, and market value. This data monitors how all commodities and products are moved globally between countries. As such, it is an important economic indicator of businesses, trade, and economic growth. The data is compiled using a variety of different sources including online resources, government, public data, shipping firms, logistics companies, and transportation organizations. It delivers unparalleled market information in a dozen languages and all currencies and is usually arranged and presented using visualization techniques and data structures employing proprietary methodologies.

This article showcases a small section of Eagle Alpha’s white paper detailing alternative data for economic trade monitoring and research. Email dallan.ryan@eaglealpha.com to request access to the full 16-page report.

Shipping

The data in this category consists of information factors that influence the performance of the cargo as well as the modes of transportation that were employed to move it. This data includes the shipper and the consignee, the loading number, the date the shipment will depart, the date it will arrive, the weight of the cargo, and the cubic metrics and TEU. Additionally, this information gives the final destination of the shipment. The shipping information provides an overview of the cost of transporting commodities and loading, unloading, and transferring the goods.

Over 80% of the global trade volume is transported by ships. The transport time can be 4-6 weeks, so the shipments are for products with a long shelf life and not for just-in-time use cases. Most data vendors report monthly data with a 4–6-week lag in the data, as it takes time to collate, aggregate, and clean effectively.

Air Freight

Air freight is associated with time-sensitive and higher-value shipments representing around 35% of global trade by value. The type of goods shipped by air are typically smaller products, goods with a short shelf life like produce or flowers, and also goods that need a fast time to market like fast fashion. COVID-19 was a big disrupter to global trade and more goods began to be shipped by air freight over the period. More and more planes used for human transport began to be used for shipping commodities.

Air freight can be carried out by dedicated planes but can also be done by utilizing the storage compartment of travel planes. Over the COVID-19 period, airlines sometimes removed seating to get more space for shipping goods. Data can be obtained on what is being shipped by air freight but not at the level of granularity of shipping data. HS code level details are not available.

Rail/Road

Road freight is widely used to distribute and deliver retail and other forms of cargo from and to various distribution centers (DCs). Road data can help you understand supply chains that run through them, traffic information to understand delays, and you can acquire insights and analytics from location and traffic data from common supply routes on the road. It is also possible to source trucking data where you can track trucking fleets. It isn’t easy to source but vendors like the American Trucking Association provide data like a monthly tonnage index based on surveys from their industry members.

Rail Transport is a commonly used mode of transport, especially in countries and continents with long transit times such as China, India, Russia, and parts of the USA. It is also possible to source rail traffic data to provide insights into railroad activities and look at rail congestion for commodity and even passenger trains. Like trucking data, rail data can be sourced by railroad associations like the Association of American Railroads or by using the Rail Time Indicators Report which is compiled using over 15 key economic indicators like consumer confidence, and industrial production which can be used to get an insight on how healthy the economy is.

Compliance Considerations

It is important to note that there is no material non-public information (MNPI) or personally identifiable information (PII) concerns in the data when the vendor agrees with official sources and governments or customs agencies, as these parties are primarily involved in major international trade agreements and the information is from public sources. Some vendors source trade data from private sources e.g., from companies’ shipping departments, or if the vendor offers software to shipping brokers that captures and organizes emails and BOL data.

If that vendor was not authorized to share this data, then there could be issues, so these types of vendors might require more stringent due diligence. In this instance, you need to ensure that you understand where the data is sourced from and how it was acquired.

Monitoring Trade Volumes

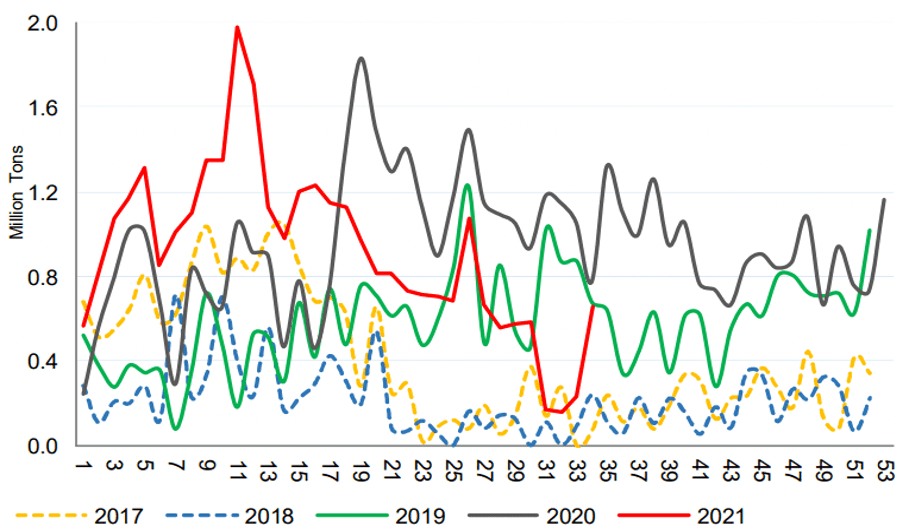

IHS Markit combines its proprietary database of ships and load/discharge locations (berths, terminals, ports) with AIS vessel movement data to create a database of laden voyages. Asset managers use IHS Markit’s Commodities at Sea database to get near real-time visibility into shifts in trade fundamentals through feeds of shipped volumes of crude oil and refined products (including coal, steel, iron ore, wheat, corn, and more).

In a 2021 report, their detailed data on India’s iron ore fines and pellet exports confirmed a sharp slowdown amid sluggish Chinese demand. Steel production cuts in Mainland China led to slow international imports and a decline in international prices for iron ore. High congestion at Chinese ports has also reduced the demand for iron ore fines/pellets from India.

Figure 1: India Iron Ore/Pellets Shipments to China (Mainland), Source: IHS Markit

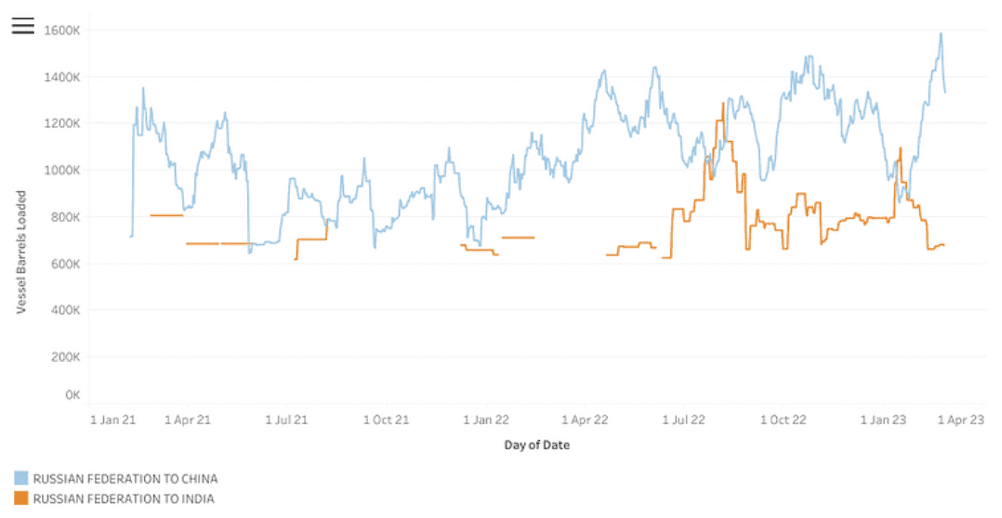

Tracking the Effectiveness of Sanctions

MariData is derived from tracking the movements of all commercial ships worldwide using Automatic Identification System (AIS) data received by terrestrial and satellite receivers. This is combined with MariTrace’s port database which defines the geospatial extents of approximately 7,500 ports worldwide, and multiple berths within the ports, allowing our system to determine when a ship has departed or arrived. The cargo type and tonnage prediction are made through a machine learning process that uses a blend of AIS, vessel and port information, records of historical trading activity, and other data sources.

In a recent report on the effectiveness of sanctions, MariTrace highlighted that the volume of Russian oil in international waters had recovered to the levels recorded in June 2022. The global fleet that is owned or controlled by Russian interests comprises about 6,500 vessels with most of the embargoed cargo now going to China and India: “Supported by new trading and financial entities that have sprung up in non-conventional hubs, far away from the incumbents in Geneva, Japan, and London, this new market is using a large (and growing) tanker fleet, logistics services from outside of the group of countries supporting the sanctions, delivering to destinations that are similarly not participating in sanctions.”

Figure 2: Oil Shipments from Russia to China and India, Source: MariTrace

Air Freight Contracts

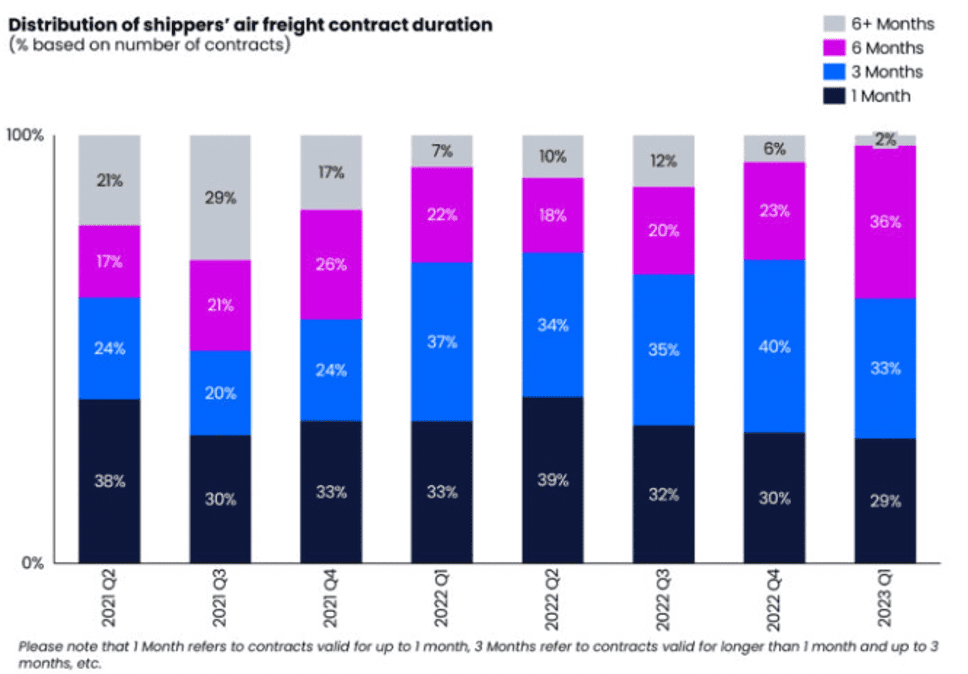

Xeneta, the ocean and air freight rate benchmarking company, acquired air freight data analytics firm CLIVE Data Services in 2022 to provide comprehensive insights and identify trends in the market promptly. In a recent report on air freight trends, Xeneta noted growth in longer-term contracts between shippers and freight forwarders. The distribution of shippers’ contract duration in the first quarter of 2023 saw the number of six-month agreements rise to 36% versus 23% in the fourth quarter of last year.

Niall van de Wouw, Chief Airfreight Officer at Xeneta, commented: “I think we’re seeing signs that some forwarders are willing to take a little more risk on what airfreight rates might do because they don’t expect the market to drop much further. The fact that we see longer-term contracts between shippers and freight forwarders is a signal that the market is stabilizing.”

Figure 3: Shippers and Forwarders Agree on Longer-Term Contracts, Source: Xeneta

Conclusion

Alternative datasets have become increasingly popular as they provide valuable insights into trade patterns, the movement of goods and services across borders, and the economic impact of trade policies and agreements. Economic trade datasets provide information on the size of specific commodities, their volume, mode of transportation, and market value, which can be used as inputs in investment decision-making processes. It is also possible to uncover new supply chain linkages and evaluate the effectiveness of sanctions among other use cases.

Eagle Alpha will return to New York on June 6th for its second alternative data event of the year. As always, they will be bringing along the top minds of the industry and have added features that both buyers and vendors have acknowledged are the most important for the day’s success including a compliance hub, as well as a data incubator and corporate data area. Register your interest to attend here.