Eagle Alpha’s Alternative Data Industry Report 2022

Introduction

Eagle Alpha’s second annual alternative data industry report explores industry-wide alternative data growth and trends, M&A in the alternative data vertical, the most engaged research and publications from the year gone by, and outlines the resolve to solve buyer and vendor needs through product development including platforms, improved taxonomy, data connectivity, and compliance features.

Throughout 2022, it was clear that the industry’s needs had changed, and it was experiencing an inflection point in the adoption of alternative sources of information. We have seen rapid vendor growth throughout the year, and an increased spread of data buyers in comparison to previous years with more private markets and consultant firms adopting alternative data. It’s been confirmed that data is the new oil.

This article is an abstract of our 2022 Alternative Data Report and features just a sampling of the trends and themes in 2022. Request report here.

A Data Sourcing Perspective

We continue to see structural growth in the industry due to ongoing data supply. On average, approximately 20 data products are added every month despite the hurdles to getting onto the platform becoming more stringent with the completion of an FISD standard due diligence questionnaire (DDQ). While the structural trends around data adoption remain robust within funds, private equity, consultants, and corporates, this year brought significant disruption to many investment strategies.

What this indicates is the need to transition from data cataloguing to data connections and data deliveries. This means an integrated workflow tool for compliance, researchers and data operations. Deeper profiling and data connections is a new development in 2022 and is being led by client demand.

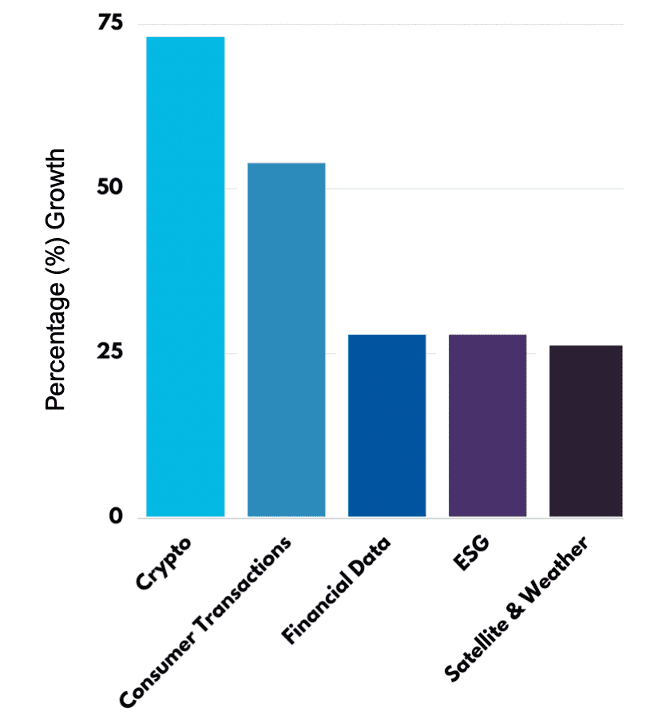

Figure 1 below shows the top five growth areas on our platform in 2022. Category growth is somewhat skewed this year due to our reclassification of data categories. However, Crypto datasets have seen strong growth as data interest was nascent in 2021 and had very strong interest in 2022. The Financial Data category grew largely on trade signaling or trading model datasets. Interest in ESG has waned this year but dataset growth remained strong in the year.

Since the launch of the industry taxonomy of 26 data categories in 2016 we have taken note that the categories have changed and evolved to be more comprehensive and reflective of the demand in the market making the case that umbrella categories with more granular subcategories are necessary.

We now have a new taxonomy of 16 primary categories and 56 subcategories. This transformation was quite complex to implement and validate, but is a much more concise classifications based on both alternative buyer and vendor requisitions.

Trends and Themes According to Eagle Alpha’s 2022 Buyside and Vendor Surveys

In late 2022, we published a follow-up to our successful 2021 buyside survey for alternative data users, this time opening submissions to data vendors to compare and contrast both perspectives.

For buyside firms, we noted that buyer spending is on the rise with 55% of respondents expecting to see 10% growth in 2022 compared with 35% of funds in 2021. Renewal rates for datasets are also on the rise at buyside funds with 80% of this year’s responses seeing renewal rates of over 75%, compared to 60% who saw over 75% last year.

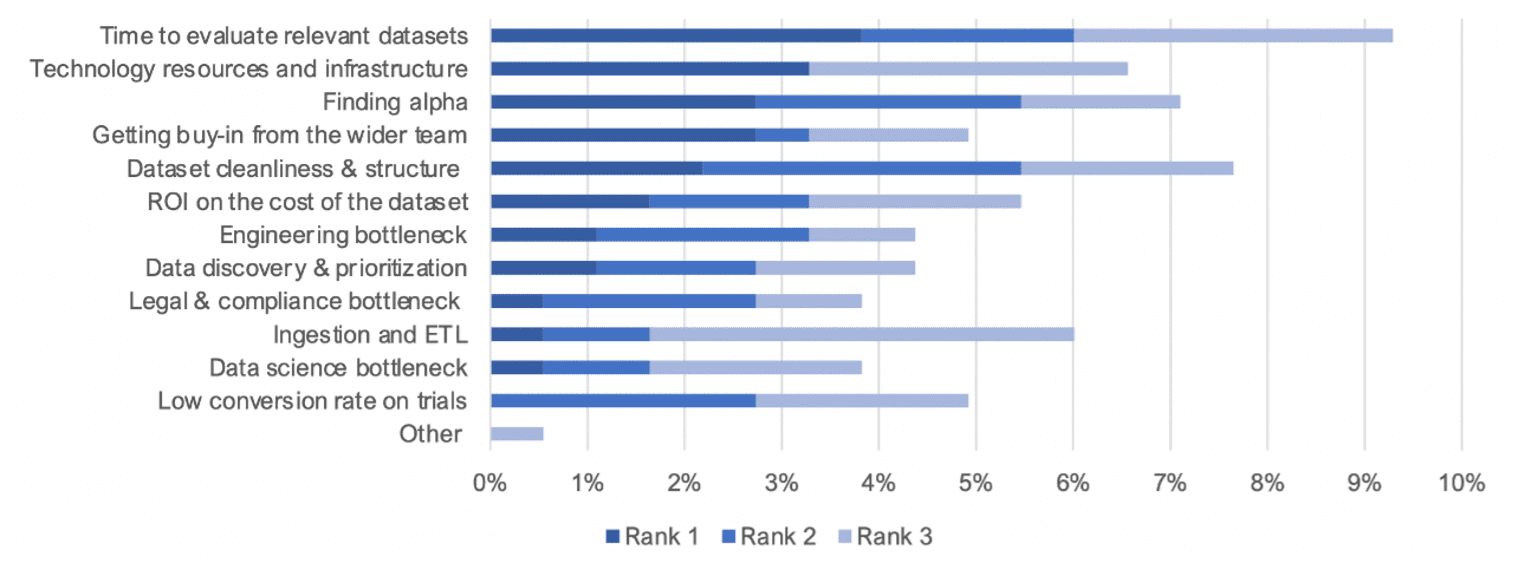

Buyside respondents placed greater importance on backtesting and portfolio construction this year when compared to last when approaching alternative data sources, while time and resources to evaluate datasets came out as a top challenge. Buyside funds also saw strong conversion rates of trial to purchase of greater than 20%, with some buyers as high as 30%.

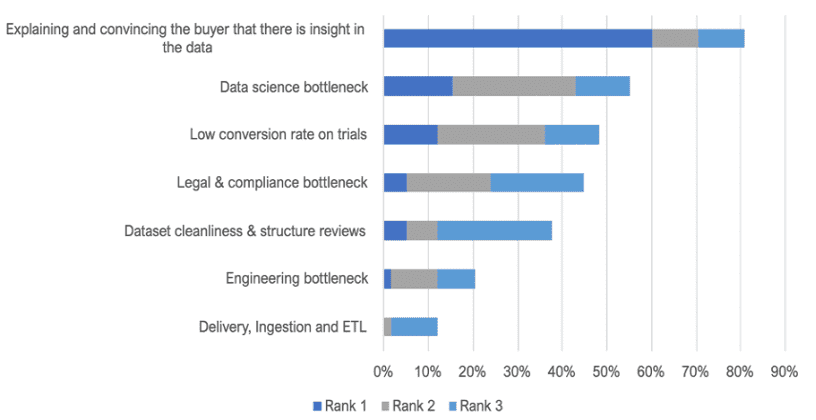

For data vendors, ongoing support and maintenance and legal and compliance were selected as the most time-consuming tasks post-trial. We believe that the increased scrutiny from regulators may have driven this change in focus from last year’s survey. The renewal rate data points are reasonably close for buyers and vendors with 90% of vendors saying that they have over 75% renewal rates.

There is a clear division between buyer spending and what vendors say as more than 50% of respondents reported over 20% growth in dataset sales in 2021 and expected the same level of development this year. Ticker coverage, ticker mapping, and uniqueness are seen as the most important aspects for data buyers when screening datasets, along with the price point. On pain points, vendors say that the size of the data provider can be an impediment to buyer interest and that they are more open now than before to market participants like Eagle Alpha providing more data insights on pre-trial data.

Key Predictions for 2023

Lastly, here are five key predictions for the upcoming year from our CEO Niall Hurley:

- Compliance scrutiny of data provenance is going to increase. Compliance teams are going to look for an increasing level of transparency in the data supply chain and the regulator is going to look for more time stamping and audit trails that capture this. Some products and categories will find it increasingly difficult to reach compliance thresholds.

- Private equity usage of data for due diligence will continue to grow and data expertise within private markets firms will continue to expand and ensure they are more comfortable with ‘raw data’ like their public market relatives.

- Vendors and buyers within the private equity vertical will consider fresh approaches to commercials, data extraction, and delivery exercises to allow alternative data to integrate better into private equity exercises.

- Compliance officers will utilize more tools and platform functionality that go beyond static document capture to align with regulatory needs.

- The sell-side banks will utilize more alternative data within their research. The gap between buyside and sell-side approaches to company analysis has grown. The former has become more data and expert network driven, this gap needs to close.

Our full report includes more granular industry trends, data sourcing, mergers and acquisitions, leading case studies, and technical product updates. Request report here.