Satellite Data for Investors: A Note on Recent Market Trends and Demand Drivers

Background

Satellite data also referred to as geospatial data, is photographic images collected by satellites orbiting the earth and can be enhanced with data from drones and radar. Asset managers first tried using satellite data back in 2010 with CNBC reporting that “Cold War-style satellite surveillance is being used to gather market-moving information”. According to the article, UBS Investment Research used data from RS Metrics to count cars in Walmart parking lots to help estimate revenues, a strategy also implemented by Walmart’s founder Sam Walton using airplanes in the 1970s.

Eagle Alpha’s first overview of the satellite data category was published in November 2015 where we highlighted several use cases, which included industrial and retail monitoring. With the commercial satellite industry growth in recent years, data availability and quality have also increased allowing data vendors to become more competitive.

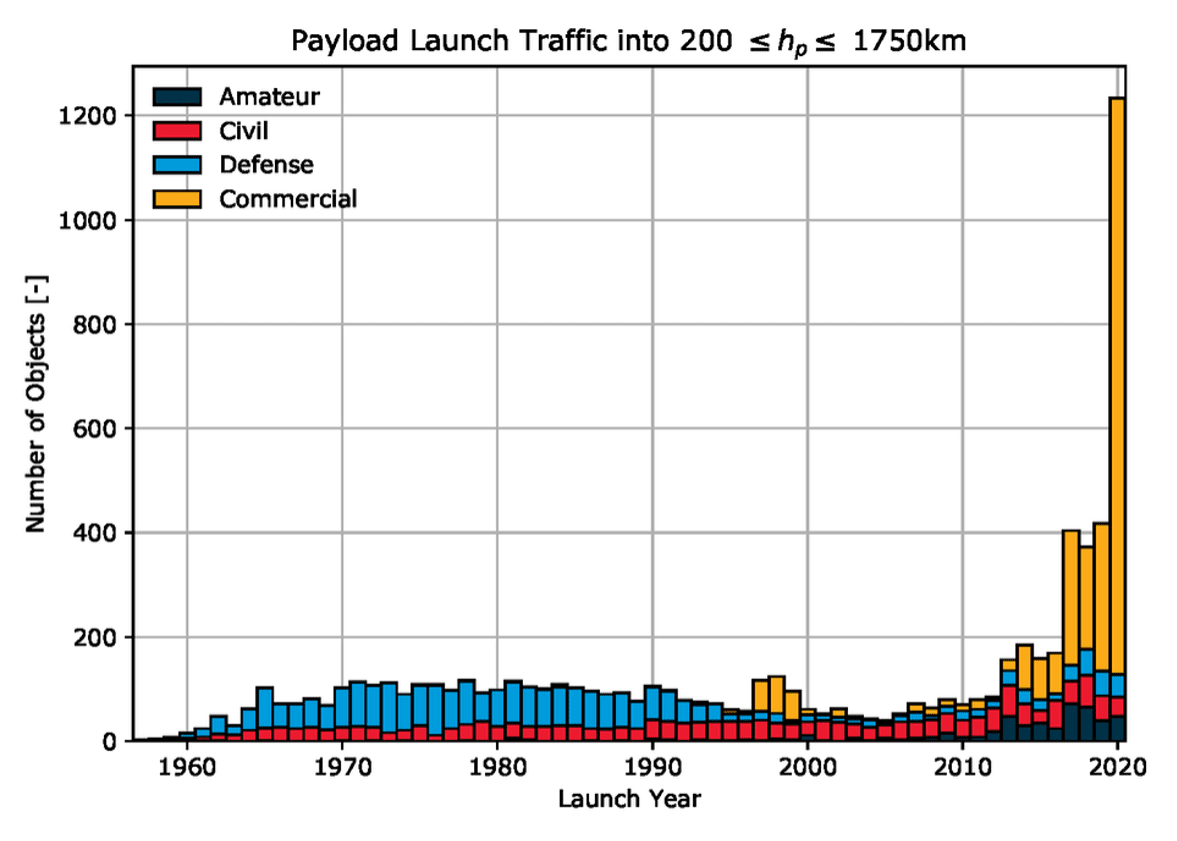

Over the last several years, the commercial satellite industry has been growing rapidly with a total of 1,713 satellites deployed in 2021 which represented a 44% increase compared to 2020. According to the Satellite Industry Association, the industry has been growing over the past five years due to decreased manufacturing and launch costs. Eased restrictions have also stimulated the industry as the U.S. Commerce Department changed the regulations governing satellite imaging companies. Figure 1 shows that the commercial satellite industry has significantly outpaced defense, civil, and amateur launches.

According to Allied Market Research, the global satellite imaging market was valued at $3.3 billion USD in 2021 and is projected to nearly triple in the next 10 years. Software-defined satellites allow users to reshape and redirect capacity according to their needs and higher market competition is bringing prices down. SpaceX and its Starlink constellation have the potential to change the industry even further and result in more timely feeds. Low Earth orbit satellites failed back in the 1990s, but McKinsey expects new business models to create more favorable conditions now.

Over 265 billion USD has been invested in space technology companies since 2012, with 2021 being a record year at 14.5 billion USD invested. Some of the mega deals included Sierra Space raising 1.4 billion USD in November 2021 and Planet Labs securing over 400 million from investors and venture capital firms. Private investments dropped in 2022 due to broader economic uncertainties with market consolidation becoming a new trend.

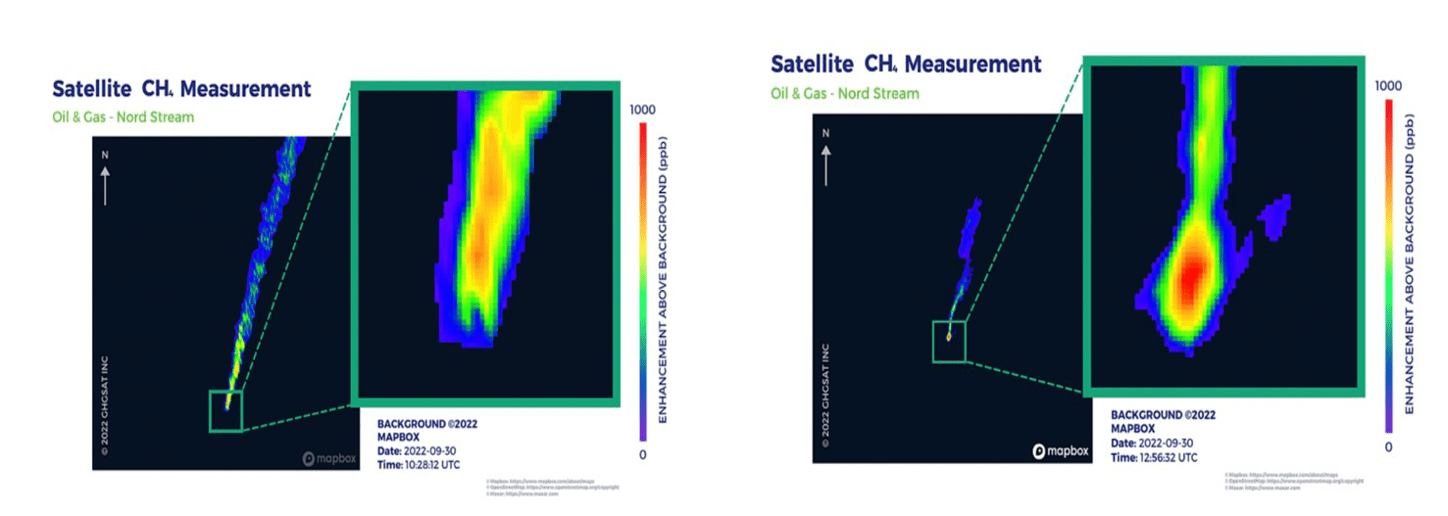

It used to cost upwards of $500 million to launch a satellite equipped with synthetic aperture radar (SAR) a technology that allows images to be captured through clouds and in the dark. However, with costs coming down commercial companies were able to start using SAR-equipped satellites, which opened new possibilities for geospatial analytics. Modern satellites also go beyond images and capture CO2, methane, and other pollutants.

Demand Drivers

Defense and commercial use are the major demand drivers for the satellite industry and investment by governments is expected to continue to fuel market growth. The security concerns are further rising as Russia has threatened that commercial satellites could become a “legitimate target” with options being discussed on how commercial satellite companies would be compensated.

A rise in demand from the agriculture industry is also expected. As global warming creates unpredictable weather patterns around the world, the demand for satellite imagery is also growing for earth observation and catastrophe management purposes. Satellite imagery is increasingly used in oil and mineral exploration, land mapping, maritime operations, and infrastructure management. We recently published a commodities deck with several satellite imagery use cases highlighted. Carbon sequestration efforts may also result in satellite imagery demand.

Most of Eagle Alpha’s inquiries coming from asset managers are to monitor commodity metals and oil. It is particularly prevalent among macro and CTA funds. The insurance industry is also embracing satellite imagery data as mentioned in Eagle Alpha’s report. ESG compliance and anti-greenwashing efforts create further demand for satellite imagery.

Top Three Most In-Demand Case Studies

Retail

During a recent Eagle Alpha workshop, Professor Panos Patatoukas from the University of California discussed how he used daily feeds of store-level parking lot traffic from two satellite vendors – RS Metrics and Orbital Insight. Prof. Patatoukas backtested the data using 4.7m daily observations across 67,078 unique store locations and 44 major US retailers against YoY same-store parking lot fill rates.

The researchers used data on daily store-level parking lot information to compile a panel of quarterly observations of enterprise-level parking lot fill rates. The backtesting showed growth in parking lot fill rates to be a significant predictor of growth in same-store sales. A long/short strategy of the results showed that satellite imagery data can generate alpha as the buy portfolio outperformed the market by 1.6%.

ESG monitoring

GHGSat’s constellation of satellites was specifically designed to analyze emissions data and will have 11 satellites by 2023 providing methane emissions analysis and adding CO2 capability. On September 30th, 2022, the largest emission from a single source that GHGSat has ever recorded was detected on the Nord Stream 2 gas pipeline.

Insurance

Comprehensive risk assessment requires a thorough analysis of environmental threats and an accurate understanding of a policy’s current condition. Recent innovations in satellite imaging and analysis are empowering actuaries to assess premiums and model inputs with primary source data, delivered at scale.

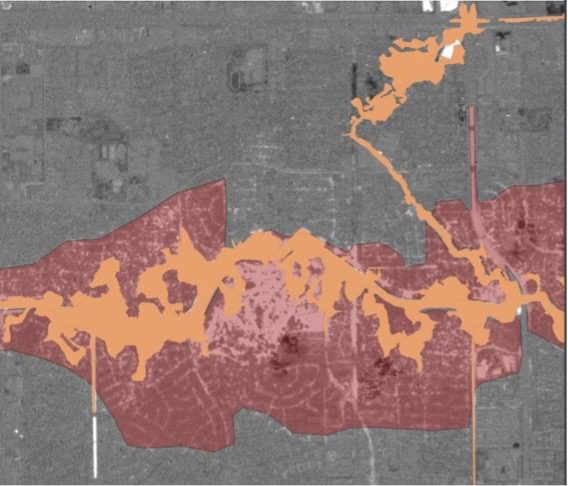

Figure 4 below illustrates Houston, Texas after Hurricane Harvey. The red area identifies true flooding through Planet’s Normalized Water Difference Index against the orange area – the Federal Emergency Management Agency’s (FEMA) Special Flood Hazard Area.

Final Thoughts

The industry has grown a lot over the last ten years. Technological advancements coupled with increased coverage of the planet resulted in more frequent observations and more data points for satellite data analytics companies to work with. Satellite imagery data has the potential to overcome traditional sources of bias such as demographic sampling errors, data corruption, and plain misreporting.