The end-to-end challenges of evaluating alternative data: And how Exabel and Eagle Alpha have partnered to solve them.

Background

According to our 2021 buyside survey of funds implementing an alternative data strategy, data budgets were forecast to grow by over 20% in 2021, and with the average spending on datasets becoming larger for recent alternative data adopters than more experienced funds, we have noticed a rapid rise in newcomers to the market. The strong growth in data spending in a tough 2020 is encouraging, as is the acceleration in 2021. This provides both significant opportunities as well as possible challenges for data vendors looking to make a name for themselves.

We found that around 50% of experienced firms using alternative data spent over $500k in 2020, while recent adopters spent only 20%. For these recent adopters, around 50% of spend is on datasets versus around 35% for more experienced funds. Overall averaged dataset costs proved to be lower for experienced funds than for recent adopters, which was a surprising result. This could be due to a lack of experience negotiating pricing, or they could be focused on more expensive ‘core’ datasets as opposed to adding lower-priced incremental datasets. This, once again, shows that there are numerous opportunities for data vendors in the alternative data space.

The Data Monetization Journey

Throughout our ten years of experience working with both buyers and vendors, we understand the process of bringing a data product to market and positioning it best for both entities to get the most out of the relationship. This section will walk through our learnings for data vendors entering the space.

-

Discovery

During the discovery stage, market intelligence is a key input into a data vendor’s strategy. This includes competitive intelligence collected by data hunters, technical advice and recommendations from data scientists and engineers, customer vertical discussions with C-suite, and pricing workshops with sales teams. Additional areas of expertise include legal and compliance considerations for specific buyers and feedback collected from previous cycles. We provide data vendors with the information needed to make these decisions.

-

Productization

During product build, advice from the data sourcing team, engineers, data scientists, and analysts can help avoid repeating the same mistakes as other data vendors. Documentation like tear sheets, data dictionaries, due diligence questionnaires (DDQs), sample data, static trial data, case studies, trial agreements, and subscription agreements are all important aspects for data buyers, and our intellectual property will shorten the sales cycle.

In addition, we coordinate beta trials and feedback to help you prioritize items to work on for a full launch, offer assistance in developing case studies to help your sales process, and provide a technical data review to evaluate your dataset through advice given by the data engineering team who ingested the data as well as a data quality report. This enables vendors to view the dataset from the viewpoint of a sophisticated buyer and make any relevant amendments before going live.

-

Go-To-Market

Our go-to-market solution is an all-encompassing platform and strategy for data vendors to get the most out of work put in during the discovery and productization stage. The vendor platform is where you list & manage your dataset profile, host data and provide dataset insights, facilitate trial data, develop a personalized CRM, and benefit from the 1-to-1 booking platform used by data buyers. We will work with you as a secondary marketing & lead generation function, helping develop proprietary data buyer insights, run targeted outbound campaigns, and organize conferences, webinars & workshops, providing a platform for your brand. Finally, since legal and compliance considerations are at the forefront of buyers’ minds, we offer one place to manage your FISD Due Diligence Questionnaires, create your FISD Standards profile, and FISD Standard Master Trial Agreement.

Challenges and Solutions

In this section, we outline the factors that affect sales volume and pricing.

- Delivery Format: To maximize the addressable market, vendors must deliver data in 4 ways: i) raw data; ii) aggregated/tickerized; iii) democratizing data through dashboards; and iv) reports.

- Relevance: To be able to sell a dataset to all buyside firms, it needs to be relevant to all types of strategies (e.g., quant, hedge, long-only) and asset classes (equity, macro, credit).

- Exclusivity: Should you offer exclusivity when selling your data? Along with our legal partners Schulte, Roth, and Zabel, we do not recommend that data owners offer exclusive deals to the buyside.

- Sales to the Sell-side: Most of our buyside clients advise vendors not to sell their datasets to the sell-side because it will dilute the alpha opportunity. If a vendor wants to sell to a sell-side firm, we recommend selling data at an aggregate level.

Pricing Considerations

There are eight key factors that vendors need to consider when pricing a dataset.

- ROI: Measuring return on investment/return on data for alternative data spending is not always straightforward. For example, some of our discretionary clients measure it based on the number of interactions with a centralized data insight team. The information derived from a dataset is part of a mosaic that leads to an investment decision. While the results of that decision are measurable, it can be difficult to determine how much credit should be attributed to each piece of the information mosaic. The frequency of consulting a dataset can be a good proxy for measuring its value to the asset management firm.

- Uniqueness: The more unique a dataset, the more valuable it can be. Buyside clients will ask how widely a dataset is disseminated. As one client put it, “3rd vs. 30th is a price driver”. Given the increasing number of alternative datasets, vendors need to ask whether buyside firms can get similar data elsewhere.

- Quant vs. Discretionary: Data vendors need to note that quants and discretionary investors have very different needs and value data differently. Quants typically want an all-in API price. Discretionary firms, on the other hand, want options that could be threefold: 1) entire datasets, 2) a subset of the dataset, and 3) per ticker.

- Asset Class: There are three primary asset classes: 1) equity, 2) macro, and 3) credit. Equity funds are the most frequent buyers of alternative datasets and therefore offer the largest addressable market. However, recently we have witnessed a steady increase in the number of inquiries from both macro and credit funds.

- Coverage: Assuming the same level of predictiveness, a dataset that covers more tickers/companies is typically more valuable. Fundamental managers might be interested in a specific sector and pay up for that. Quants, on the other hand, consider what length of history is available and how has coverage changed over time which is key to determining how suitable the dataset will be for backtesting.

- Comps: Most vendors don’t know the typical price point for alternative datasets in general and datasets they are in direct competition with. Pricing needs to be in line with comparable datasets that are already available to the buyside.

- License Structure: Most licenses are sold on annual contracts on a per ‘team’ basis. Some of our buyside clients consider enterprise pricing as more valuable and won’t engage with vendors offering usage-based structures.

- Feedback: Dataset vendors should continually analyze feedback from asset managers. The data market is undergoing rapid change, as are the techniques for analyzing data.

Exabel and Eagle Alpha partner to deliver the solution.

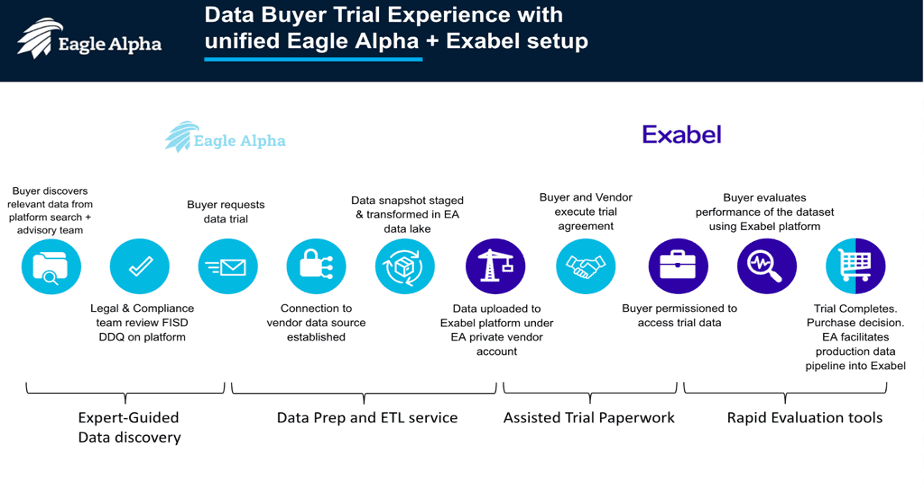

Exabel and Eagle Alpha’s partnership takes on this challenge end to end. By combining Eagle Alpha’s deep knowledge and expertise in the alternative data ecosystem with Exabel’s powerful analysis platform, investment teams can finally tackle these operational and technical challenges holistically, delivering efficient data evaluation, at scale.

Here’s how it works;

- Investors browse Eagle Alpha’s 1,650 alternative datasets profiled to FISD standards, utilizing Eagle Alpha expert consulting and an online platform to accelerate the process of scouting for new potentially potent data sets.

- With 600+ DDQs completed, time-stamped, and maintained, Eagle Alpha dramatically reduces data compliance checks on the buyer’s behalf.

- Contracting for trial data is streamlined with Eagle Alpha’s unique approach to pre-agreed template contracts with buyside firms, tuned to data evaluation

- By leveraging the cloud-based Exabel platform evaluation of data remains at ‘arm’s length’ outside the buyer’s firewalls, reducing internal IT Security approvals

- Eagle Alpha data engineers ingest test data into the Exabel platform, cleaned, mapped, and organized, removing the data-engineering friction for the buyer.

- Data is delivered into the buyer’s dedicated, secure namespace in the platform. The evaluation project is teed up, and ready to go.

- Using Exabel’s purpose-built data research and analysis modules buyers rapidly execute systematic evaluation processes, from correlation analysis, signal alpha testing, prediction modeling, and strategy backtesting, supported with on-call expert assistance and best practice data evaluation guides to rapidly make go/no go buying decisions.

All of which makes for Rapid, low-risk, and cost-effective, alternative data evaluation – at scale.

If you would like to learn more, sign up for the jointly sponsored webinar panel discussion from Eagle Alpha and Exabel on Alternative Data Evaluation here.