Alternative Data for Monitoring the Most Squeezable Stocks in the United States

The following guest article was written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, a market-leading financial data and technology company that provides Pricing and Analytics for Capital Markets and Solutions that connect clients to their critical investment data. For more information on S3 Partners, or to book a meeting with their team, please click here.

Background

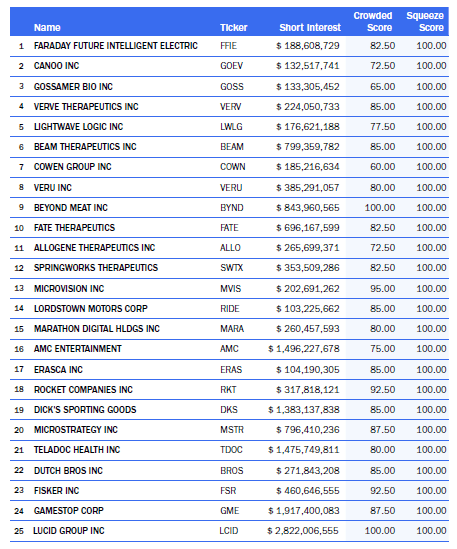

The recent rally off the June 16 lows (S&P 500 +5.36%, Nasdaq +7.57%, Russell 3000 +5.42%) has made some crowded shorts more squeezable. We have seen the number of highly squeezable stocks in our Squeeze metric since June 15 more than double, and our average squeeze score has increased by over 250% (from 12.22 to 31.48). The Consumer Discretionary (primarily auto) and HealthCare (Biotech) sectors have the most constituents in the top 25 most squeezable stocks.

Our Crowded Score takes a multi-factor approach to identify short-side crowded securities and take into consideration:

- Total short dollars at risk

- Short Interest as a true percentage of a company’s tradable float (which includes synthetic longs created by short selling).

- Stock Loan liquidity

- Trading liquidity

While a stock can be “crowded” it might not necessarily be a short squeeze candidate. An additional variable which is necessary for a short squeeze to occur is substantial net-of-financing mark-to-market losses. A short position, no matter how crowded, that continues to be profitable cannot be squeezed. No trader will be forced to exit a position that continues to be profitable. They may exit or trim their positions if trading or stock loan liquidity diminishes significantly or if their expected Alpha is reached and there are more attractive trades elsewhere. But they will usually continue to “ride the wave” until the wave dissipates, or they are forced out by market conditions such as stock recalls or unpalatable stock borrow fees.

The stocks in our top 25 list all have elevated S3 SI % Float and days-to-cover. Stock borrows are tight in most of these stocks with only six trading at General Collateral levels and twelve are trading at above 10% fee levels. And finally, all these stocks have incurred double digit percentage mark-to-market losses over the last 30 days coupled with mark-to-market losses over the last seven days.

Having a high Squeeze Score does not guarantee that a stock will be squeezed – but it does highlight stocks that a have a much higher squeeze potential than most other stocks in the market. If a trader has significant historical profits in a stock; very high conviction in their investment\trading thesis; a technical or quantitative reason to be in a stock; or is very stubborn with a thick skin for enduring mark-to-market losses, they may remain short in a stock despite its high Crowded and Squeeze scores.

But the chances of getting a tap on the shoulder from a Chief Risk Officer to cut losses and get out of the trade is higher for these stocks. The higher chance that short sellers may be forced to buy-to-cover will only help push stock prices even higher – and making the Squeeze even tighter for the shorts still in the stock.

The information herein (some of which has been obtained from third-party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.