“Eurozone inflation to burn hotter, but ECB rates to stay on ice”

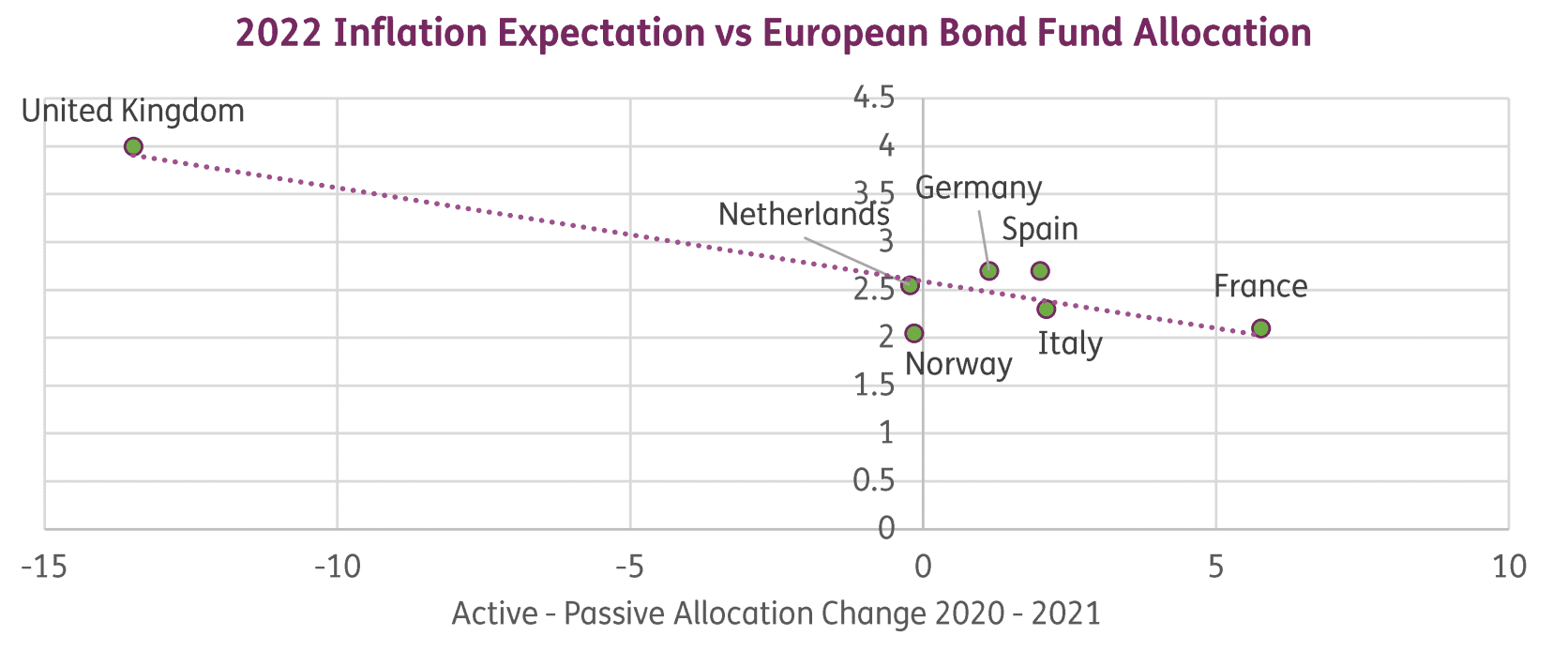

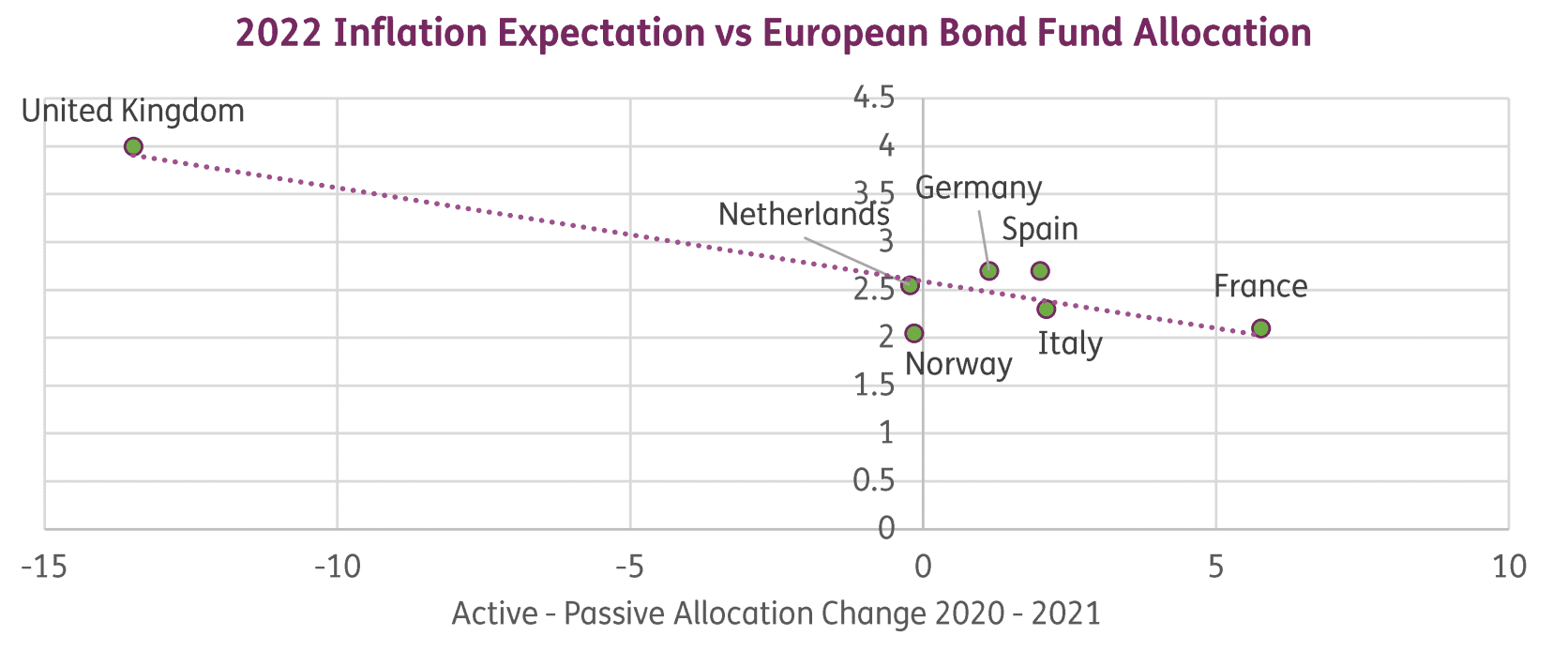

View from EPFR Informa Intelligence: Inflation forecasts for 2022 saw a steady increase across Europe last year, driven in part by bottlenecks in supply chains, and rising energy and food prices. For EPFR-tracked Europe Regional bond funds, the extent of this peak in consumer price expectations across European countries has been reflected by a more pronounced downturn in Active vs Passive fund positioning. Active fund manager sentiment towards countries with higher forecasts, such as the UK, has become more bearish compared to 2020 end-of-year allocations. In this example, the spread between these fund groups dropped from +2.9% to -10.5%.

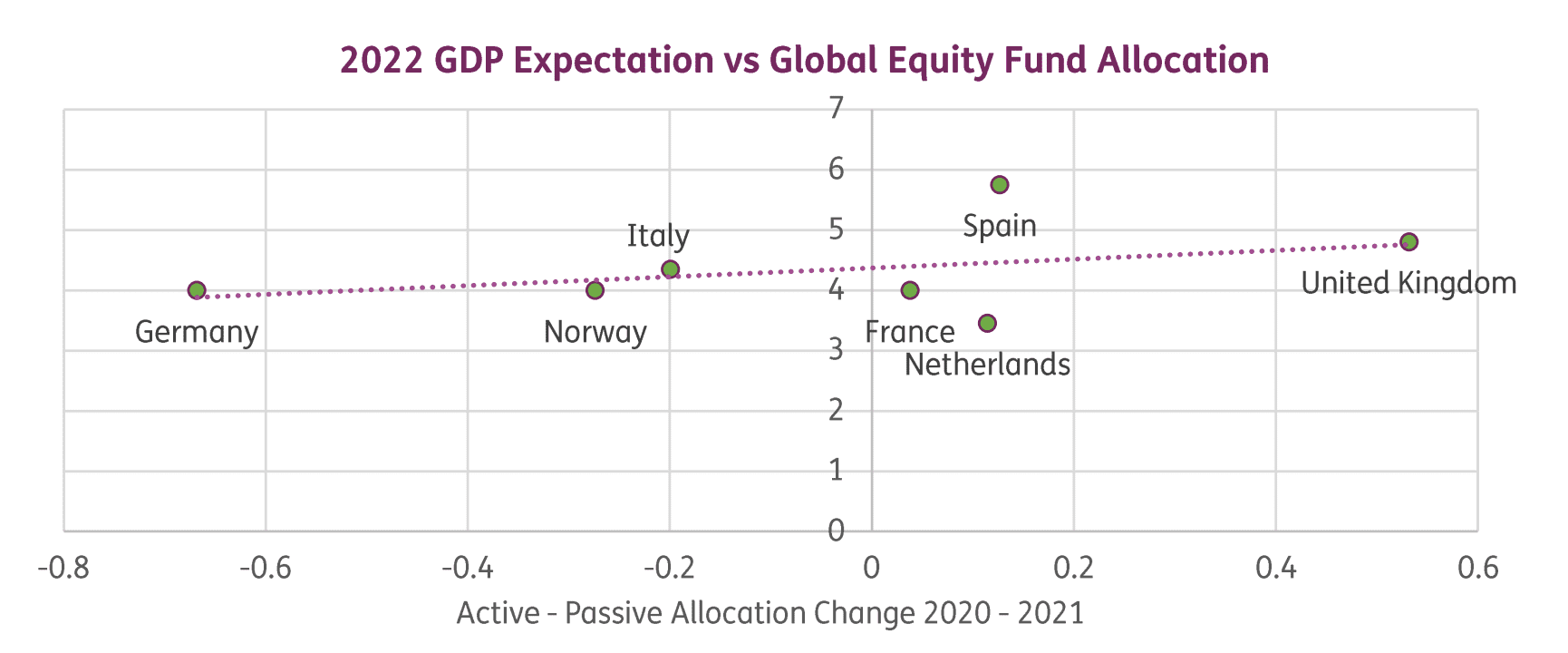

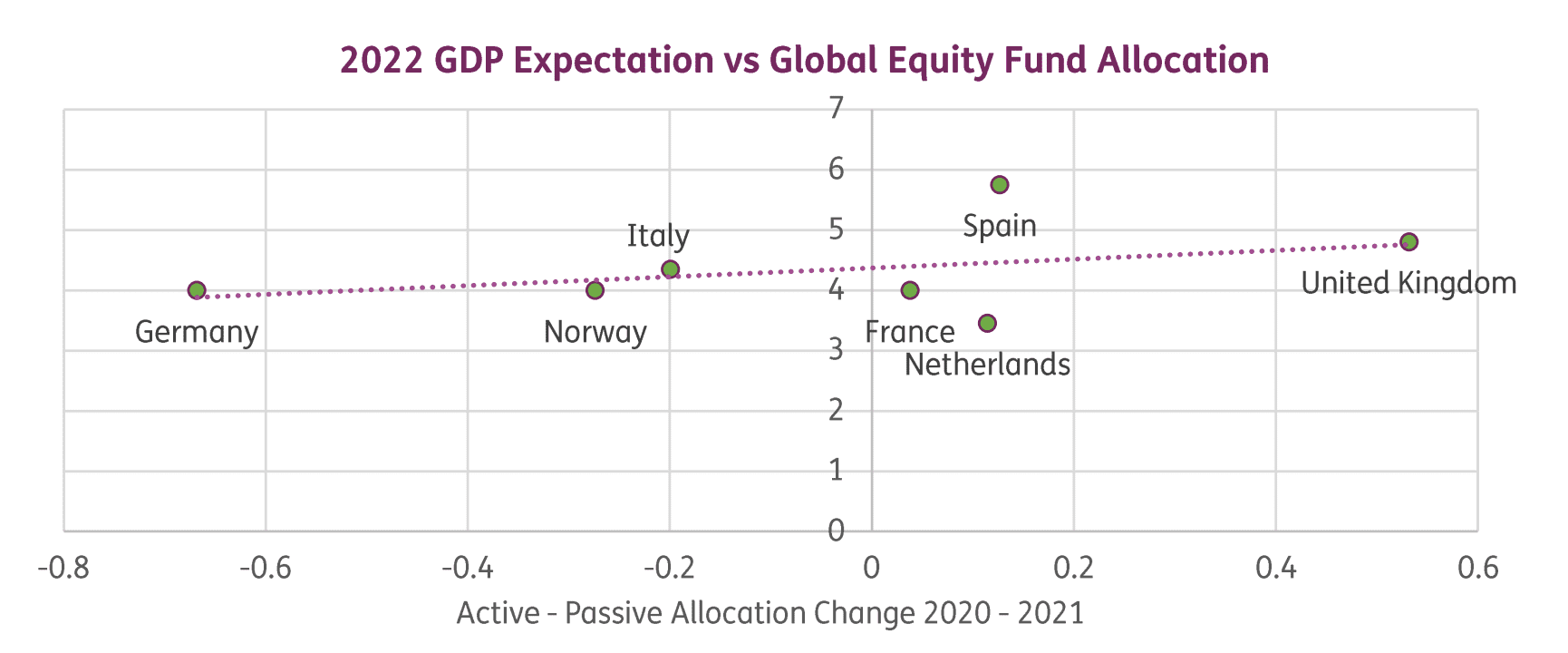

Economists’ forecasts for GDP also increased throughout 2021. On the Global equity fund positioning side, Active vs Passive allocations saw a positive correlation with 2022 GDP expectations, as confidence tentatively built in the passing of the Omicron wave. The absolute changes in Active vs Passive equity allocation is noticeably less prominent than their bond allocation counterparts. As identified by Reuters, this more cautious sentiment could be attributed to continuing virus containment measures and potentially slower growth as higher inflation erodes household spending power and consumption.

About EPFR

Informa Financial Intelligence’s EPFR, a subsidiary of Informa plc (LSE: INF), provides fund flows and asset allocation data to global financial institutions gleaned from a universe of over 142,000 share classes domiciled globally encompassing over $52.5 trillion in assets. Our data helps portfolio managers, asset allocators, strategists and research teams generate alpha by giving them a clear picture of where money is moving, how fund managers are investing that money, and what impact those shifts are having on geographies, sectors, industries and securities. For more information, contact: sales.financial@informa.com

View from EPFR Informa Intelligence: Inflation forecasts for 2022 saw a steady increase across Europe last year, driven in part by bottlenecks in supply chains, and rising energy and food prices. For EPFR-tracked Europe Regional bond funds, the extent of this peak in consumer price expectations across European countries has been reflected by a more pronounced downturn in Active vs Passive fund positioning. Active fund manager sentiment towards countries with higher forecasts, such as the UK, has become more bearish compared against 2020 end-of-year allocations. In this example, the spread between these fund groups dropped from +2.9% to -10.5%.

Economists’ forecasts for GDP also increased throughout 2021. On the Global equity fund positioning side, Active vs Passive allocations saw a positive correlation with 2022 GDP expectations, as confidence tentatively built in the passing of the Omicron wave. The absolute changes in Active vs Passive equity allocation is noticeably less prominent than their bond allocation counterparts. As identified by Reuters, this more cautious sentiment could be attributed to continuing virus containment measures and potentially slower growth as higher inflation erodes household spending power and consumption.

About EPFR

Informa Financial Intelligence’s EPFR, a subsidiary of Informa plc (LSE: INF), provides fund flows and asset allocation data to global financial institutions gleaned from a universe of over 142,000 share classes domiciled globally encompassing over $52.5 trillion in assets. Our data helps portfolio managers, asset allocators, strategists and research teams generate alpha by giving them a clear picture of where money is moving, how fund managers are investing that money, and what impact those shifts are having on geographies, sectors, industries and securities. For more information, contact: sales.financial@informa.com