This is the first in a two-part blog series where Eagle Alpha’s Director of Data Strategy and Analytics Ronan Crosson shares his insights into the topic of Geo-location data. In this post, Ronan explores the opportunities presented by Geo-location data, specifically in the context of the COVID-19 pandemic. In the next post, Ronan will explore some of the challenges of working with Geo-location data.

Data Strategy is the Eagle Alpha solution for assisting firms to get to best practices with their alternative data strategies.

Background

We have seen unprecedented growth in client interest and use of Geo-location data since the beginning of 2020, to the extent that it is now one of the most popular alternative data categories for our clients. This has not always been the case. Traditionally consumer transaction and web crawled data claimed that mantel. We are seeing elevated interest in the category from our traditional customer base in the hedge fund and asset manager industries, but also private equity funds, corporate, central banks, and government agencies. This unprecedented growth in interest has unquestionably been driven by the COVID-19 pandemic.

What is Geo-Location Data?

Before we get into the why of Geo-location data, it makes sense to focus on the what. What is Geo-location data and how is it collected?

This is a topic that we discussed at great length in a recent alpha workshop we hosted. The most common sources of Geo-location are:

-

Cellular tower triangulation: This is good for tracking the mass movement of people.

-

GPS referencing: Once a device communicates with a cell phone tower, it tries to locate the GPS.

-

Apps tracking: Records locations based on data tracked from apps.

-

Other: Bluetooth beacons and wi-fi referencing provide extremely accurate and valuable insights into visitations within buildings such as shopping malls.

The Value of Geo-Location Data

During the same workshop we had Jim Kyung-Soo Liew, Associate Professor of Finance at Johns Hopkins University, explain how he and his colleagues used Geo-location data. He presented an example analyzing a pairs trading strategy of Under Armour and Nike, demonstrating that Geo-location activity in different retail shops predicted spreads between Under Armour and Nike stock prices.

Zain Hoda, the founder of research firm Alpha Hat, also shared his experience of working with Geo-location data and demonstrated a fundamental use case analysing the performance of Kohl’s stores that featured in a pilot whereby Amazon customers could return their purchases to Kohl’s stores.

Figure 1: Analyzing Store Level Performance using Geo-location Data – Kohl’s stores that participated in the pilot with Amazon saw an average 8.5% uplift in traffic. (Source: Eagle Alpha Data Partner).

Source: Eagle Alpha Geo-location Partner

Alpha Hat’s analysis showed an 8.5% increase in traffic to the test stores compared to the control stores.

We also provided a host of examples of how Geo-location can be helpful to analysts in the latest version of our COVID-19 report, updated in June this year.

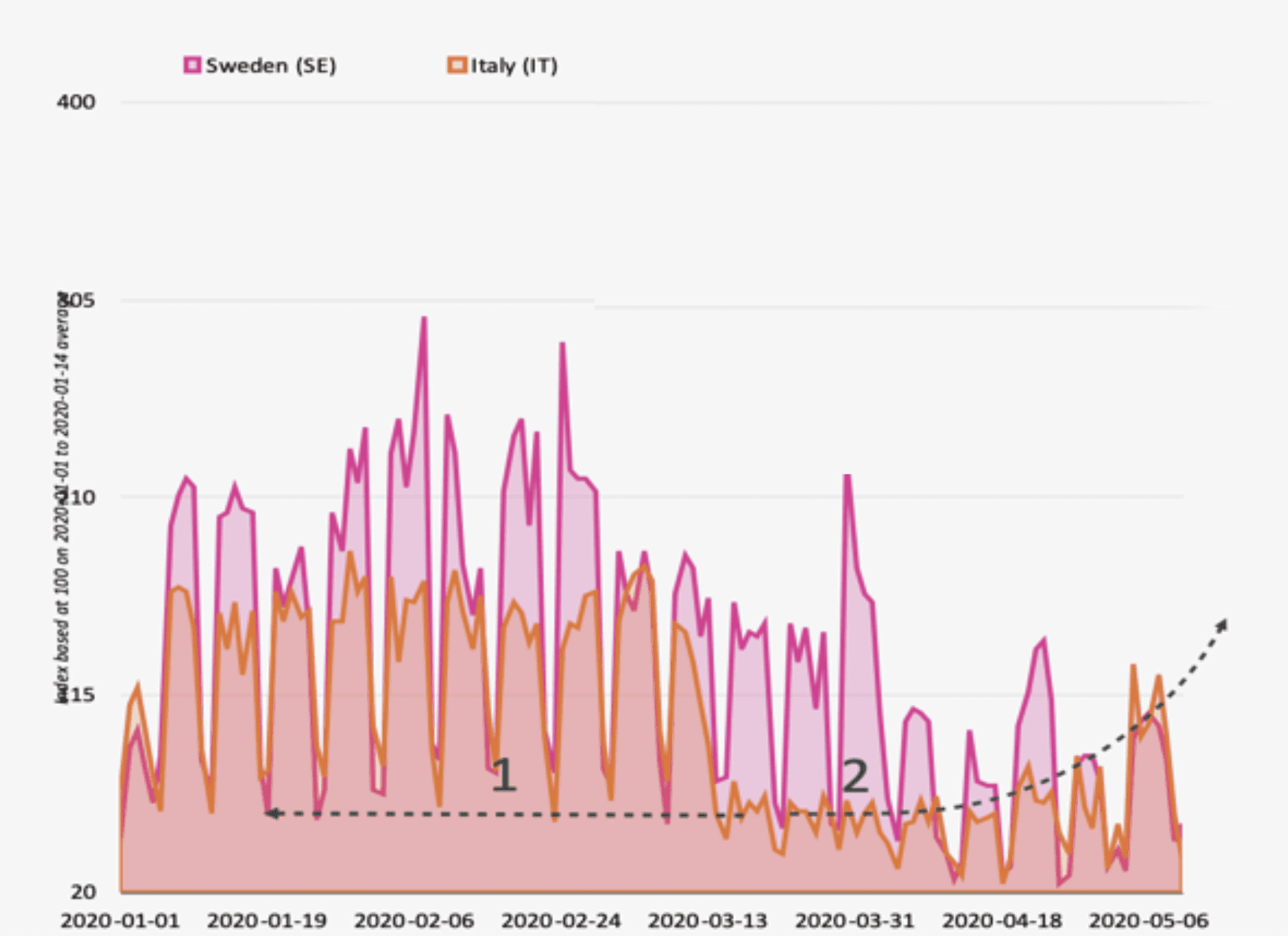

One of these examples explored how Geo-location data can provide timely and measurable metrics on the impact of COVID-19 on economic activity. We noted that Italy was seeing levels of workplace activity more typical of the weekend activity in pre-COVID times. Then in Sweden, the extent of the decline in workplace activity was also notable given the country did not institute the same level of lockdown as other countries (see figure 2 below). In fact, a similar trend is seen repeating globally. Workplace attendance and visits to locations tagged as consumer discretionary and staples remain low, even in countries with a relaxed lockdown. Easing restrictions doesn’t bring about a complete change in consumer behaviour.

In the same report, we also highlighted several stock and sector use cases for geo-location data. One was using the data to track the precipitous decline in footfall at Macau casinos. Another explores how the decline in international travel by Chinese consumers has impacted hotels and retailers globally.

Click here to request a copy of Eagle Alpha’s COVID-19 white paper.

Figure 2: Tracking People Movement in Europe Using Geolocation Data. Italy C19 workplace activity in May was equivalent to Pre-C19 weekends or public holidays. Even though Sweden did not institute a lockdown in the same way as Italy did, workplace attendance fell significantly. (Source: Eagle Alpha Data Partner).

Conclusion

It is plain to see why Geo-location data has seen such strong interest in 2020 given the breadth of unique insights possible using this form of alternative data. It is for this reason that central banks and government agencies, as well as hedge funds, are increasingly looking to the data to provide near real-time insights into the consumer and general economy. However, the data set is not without its challenges. Something I will discuss in my next post.

[If you would like to learn more about any of the data sources mentioned or how Eagle Alpha is helping clients in the current environment then please contact us at inquiries@eaglealpha.com]