Understanding Consumer Transaction Data is essential for businesses and investors aiming to stay ahead of market trends and consumer behavior. This powerful data type, which captures detailed purchasing activities, offers crucial insights into revenue forecasts and strategic decision-making. By harnessing consumer transaction data, companies can not only predict future performance but also gain a competitive edge in the rapidly evolving market landscape. Explore the latest trends and insights that are shaping how businesses utilize consumer transaction data effectively.

What Is Consumer Transaction Data?

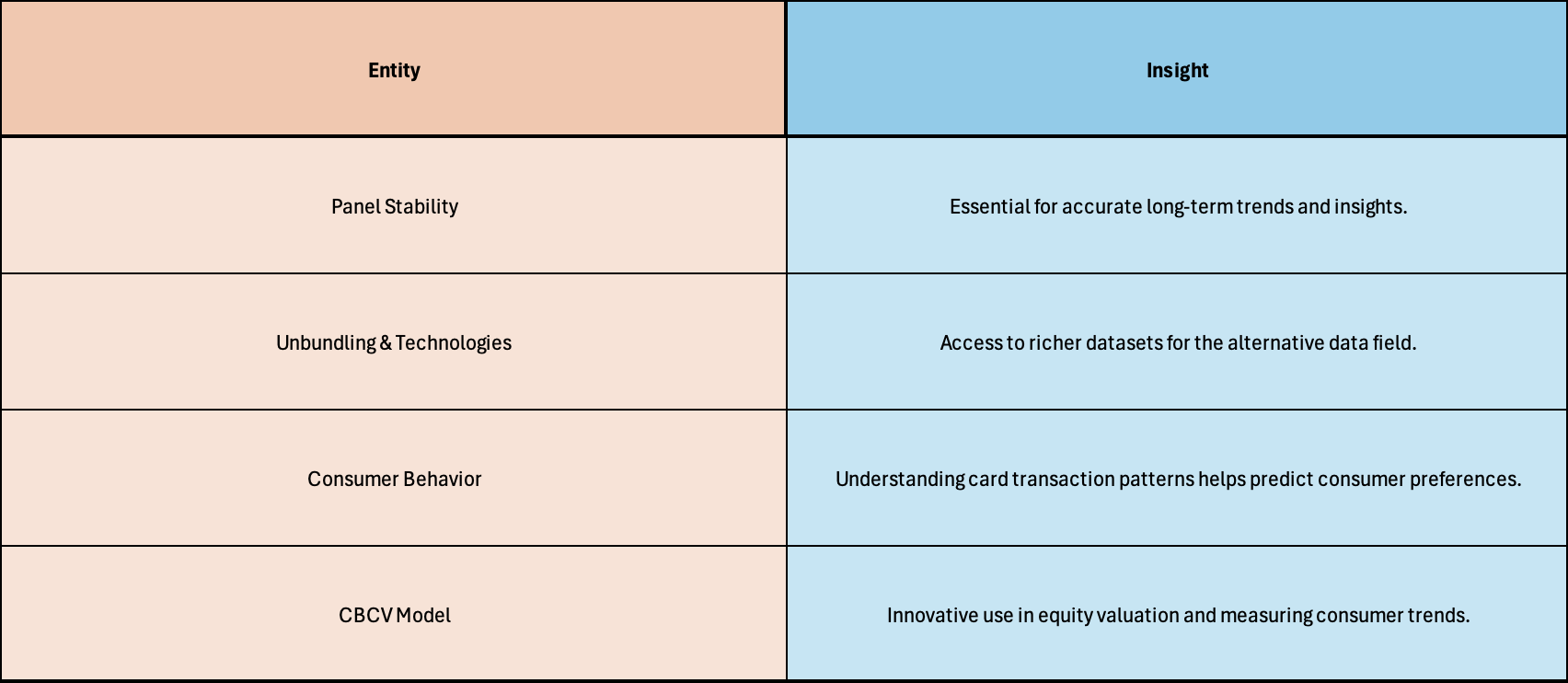

Figure 1: The Growth of Consumer Transaction Datasets over Time on Eagle Alpha’s Explorer Platform (Source: Eagle Alpha)

Understanding the Role of Consumer Transaction Data

Consumer Behavior and Company Performance:

-

Transaction data from consumers provides valuable early indicators of revenue growth and earnings for companies, especially within retail sectors.

-

Investment professionals utilize this data to anticipate if a company will surpass or fall short of financial analyst predictions.

Insight into Spend Trends:

-

Available before the release of quarterly financial reports, it serves as a tool for estimating future performance.

-

A notable correlation exists between transaction data and reported company revenues, as illustrated in available studies.

Strategic Business Decisions:

-

Beyond revenue predictions, it aids long-term investors in understanding shopper behaviors and responses to new products.

-

The impact of sales promotions and discounts on consumer spending habits can be assessed through a thorough examination of transaction data.

Resource Hub for Transaction Data Application:

- Industry experts have amassed a wealth of knowledge, including practical use cases, workshops, and key legal considerations in utilizing consumer transaction data.

- It proves to be an essential feed for diverse industries to align their strategies with consumer dynamics.

Exploring Consumer Financial Interactions

Consumer financial interactions encapsulate a broad array of information arising from an individual’s purchases and business dealings. This detailed financial snapshot includes:

- Payment methods used such as credit cards and debit cards

- E-receipt collection from email inboxes

- Insights from point-of-sale (POS) systems

- Data from fintech applications like PayPal

-

Aggregate Analysis: Broad sector-level overviews.

-

Detailed Assessment: Examination at merchant, company, or product scales.

Insights from Specialized Workshops on Consumer Transaction Data

Highlighting Key Consumer Data Trends

Thomas Combes, by exhibiting data from a comprehensive quality report, underscored the significance of panel steadiness, which considers the variations in transaction volume by card type. He emphasized how vendors might apply specific filters to data, ensuring that business strategies are based on reliable and steady datasets.

Experiences of Seasoned Experts

Leveraging Data for In-Depth Market Analysis

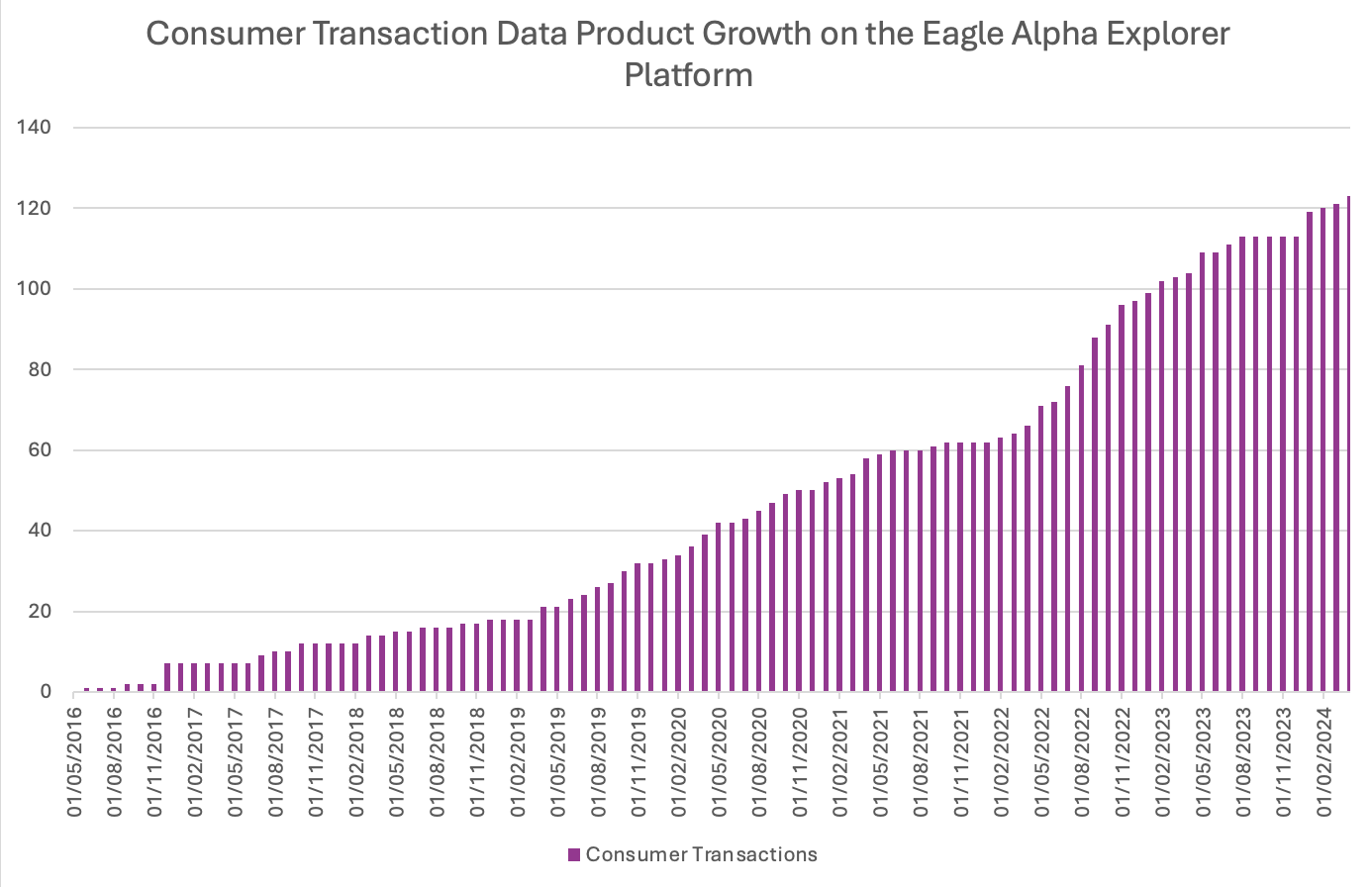

Table: Key Points from Workshops

Analytical Insights: Understanding Consumer Market Dynamics

-

Market Expansion: McDonald’s expansion in breakfast delivery service

-

Partnerships: Collaborations with delivery services

-

Outcome: Growth in market share during the pandemic’s peak

Strategists and investors turn to such illustrative cases to interpret intra-quarter business trends. For instance, this approach enables a granular look at Disney+ subscriber growth, guiding both analysts and hedge funds in making informed projections. Precise transaction data not only pinpoints customer retention rates, such as those observed with Netflix—where a significant majority maintain their subscription after a year—but also provides a window into market shifts.

-

Subscriber Patterns: Disney+ growth trends

-

Customer Loyalty: One-year retention rates for Netflix

-

Data Source: Credit and debit card transactions

These data-driven narratives, invaluable to Bloomberg Terminal and Bloomberg Second Measure users, offer a forward-looking perspective for investors during volatile economic times like the COVID-19 pandemic.

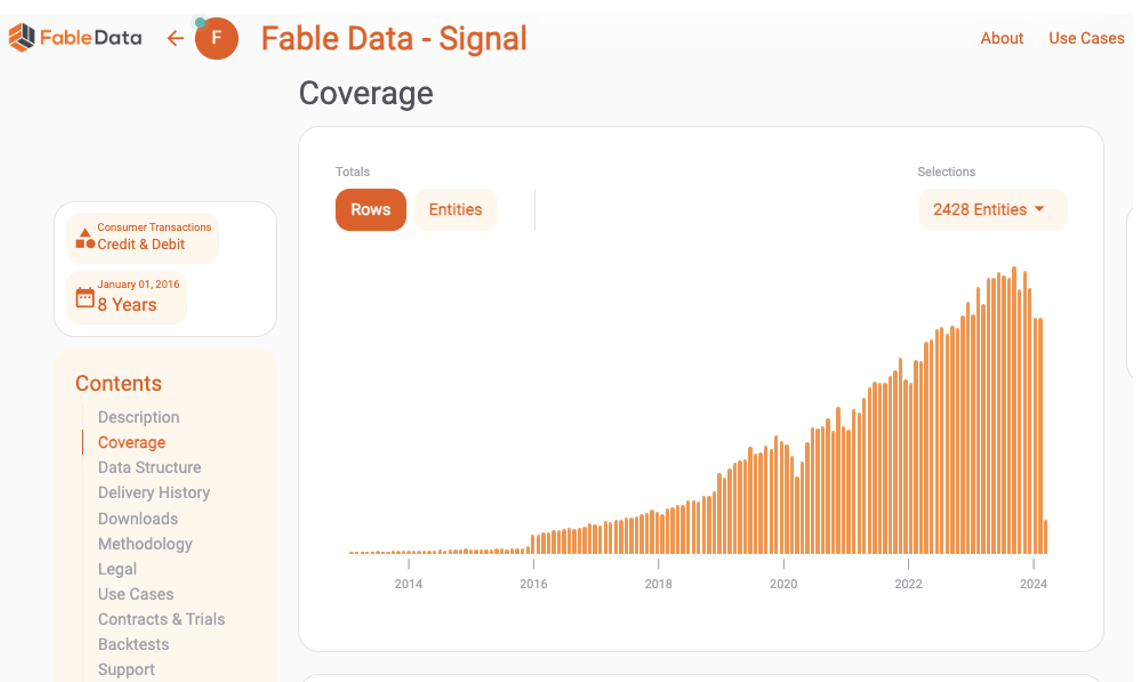

As per the infographic in the first paragraph, there has been an increase in consumer transaction data providers coming to market and it is now possible to get quality consumer transaction data outside of the US. For example, there are consumer transaction data providers, like Fable Data, that offer pan-European consumer transaction data. Fable Data began delivering consumer transaction data from the UK but now offer data across many European regions and as you can see below, have steadily grown their panel over time, covering over 2400 tickers now.

Figure 2: Fable Data’s Storefront of Eagle Alpha Explorer Platform. (Click on the image to explore Fable Data’s coverage and Data Structure.)

Legal Aspects of Handling Consumer Transaction Information

-

PII Protection: Safeguarding individual identifiers necessitates robust security and restricted data access protocols.

-

MNPI Concerns: Transparency around non-public financial information is critical to avoid insider trading implications.

-

Data Origin Tracking: Documenting the lineage of data is crucial for authenticity and compliance purposes.

Concluding Insights

-

Implementation Considerations

-

Legal Compliance: Immutable compliance with legal frameworks is paramount.

-

Data Acquisition Costs: Notwithstanding the expense, the benefits justify the investment for many firms.

-

-

Usage Across Industries

-

Utilized for generating signals for trade strategies.

-

Informs long-term analysis for sustained investment planning.

-